Have you ever wondered who selects the funds in your 401(k) plan and why? It’s a common assumption that the funds are tailored to your age or eligibility, but often, they are chosen based on plan benefits and incentives rather than individual needs. This means that many 401(k) plans limit you to index funds or company stocks, while excluding individual stock options.

The Real Impact of Limited 401(k) Fund Choices

The limitations in your 401(k) fund options might seem minor, but they can significantly affect your financial future. Contrary to popular belief, not all funds overlap in the indices they track. The differences in returns and fees between funds can greatly impact your retirement, potentially altering your financial security.

A striking example is the lawsuit against a financial services firm by its own employees, who accused the firm of allocating retirement funds to high-fee proprietary 401(k) funds. According to a report by the White House Council of Economic Advisors, conflicted advice costs Americans a staggering $17 billion annually.

So, how can you ensure you are selecting funds that offer the best performance at the lowest cost?

Warren Buffett’s Simple Solution: Indexing

Warren Buffett advocates for index funds in his letter to shareholders, stating, “Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees.” Index funds allow you to invest in all the stocks of an index at a low cost, often outperforming the market after accounting for fees and expenses.

The Pitfalls of Active Management in 401(k) Plans

Not all 401(k) plans are created equal. Even if your plan offers low-cost index funds, some financial advisors may create brokerage-linked accounts, adding fees that can erode your benefits. This practice, designed to earn managed fees, often leaves investors with diminished returns, contrary to the goal of minimizing fees. Make sure you have evaluated the trade offs by doing the research and the value add your advisor brings to the table.

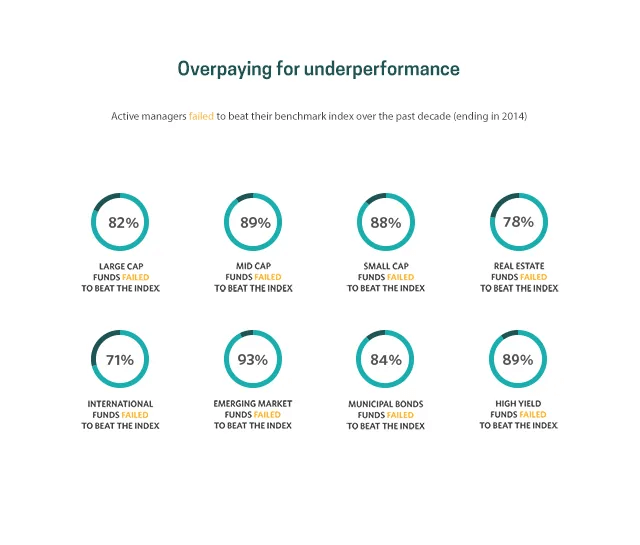

Key Findings from SPIVA Data:

- Large Cap Funds: 82% of actively managed large cap funds failed to outperform their benchmark index over the past decade.

- Mid Cap and Small Cap Funds: 89% of mid cap and 88% of small cap funds failed to beat their indices.

- Specialized Sectors and International Markets: 93% of emerging market funds and 71% of international funds did not outperform their benchmarks.

- Bond Funds: 84% of municipal bond funds and 89% of high yield bond funds underperformed.

The Cost of Underperformance

The cost of underperforming active funds goes beyond lost potential gains; it includes higher fees that erode your retirement savings. Actively managed funds often charge fees 10 to 30 times higher than passive index funds.

What We Recommend at Finomenon Investments

The evidence is clear: actively managed funds in 401(k) plans often fail to deliver the promised market-beating returns, especially when accounting for advisor fees. By choosing low-cost index funds, you can maximize returns while minimizing costs, setting a stronger foundation for a secure retirement.

At Finomenon Investments, we recommend maximizing your 401(k) contributions, exploring eligibility for mega backdoor Roth strategies, and taking advantage of our complimentary ongoing 401(k) reviews as part of our comprehensive financial planning and managed services.

Speak to Us Today About Your 401(k) Questions and to assess your 401(k) fees and explore your options, book a call with us today.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuations in value. Finomenon Investments LLC cannot guarantee future financial results.