Managing personal finances can be tricky, especially when it comes to rolling over old 401(k) accounts. Many people overlook the hidden costs of handling it themselves, leading to missed opportunities and avoidable issues. At Finomenon Investments, we often see the problems that arise during the rollover process.

A Recent Case Study

We recently helped a client with several old 401(k) accounts from previous employers. She hadn’t had time to review or consolidate these accounts and was unsure how her contributions had grown. Her goal was to enhance the performance of these investments. While it might seem like a few clicks should do the trick, the reality is quite different.

Here’s What Happened

- Online Obstacles: The rollover process couldn’t be completed online. We had to print and sign forms, so we contacted Fidelity for help with the details.

- Paperwork Hassles: The paperwork required signatures from the plan sponsor—her old employer—before we could proceed. This added an extra layer of complexity.

- Check Issuance: Instead of a direct electronic transfer, Fidelity sent a paper check. This is a common source of confusion.

- Manual Deposit: The paper check needed to be deposited into the new IRA account manually, adding more steps that can lead to errors.

- Reinvestment Decisions: Once the funds were in the new IRA at Finomenon Investments, we worked on reinvesting and adjusting the portfolio. This crucial step ensured the funds were aligned with her future goals and cash flow needs.

The Takeaway

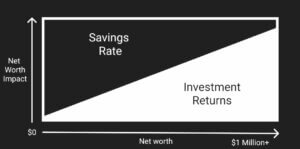

From start to finish, the process took about 12 days. The cost of delays and inaction can be significant—something often underestimated by DIYers.

This experience shows how complex managing personal finances can be. Although rolling over an old 401(k) might seem simple, getting professional help can prevent costly mistakes and ensure your investments are working for you. Don’t rely on guesswork or incomplete information—seek expert assistance to make informed financial decisions.

Disclaimer: This content is not investment advice. All investments carry risks, including the potential loss of principal and value fluctuations. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.