Understanding the 4% Rule: A Simple Guide to Retirement Planning

Retirement planning can feel overwhelming, but one principle stands out for its simplicity and reliability: Understanding the 4% Rule. This rule offers a straightforward method to estimate how much you need to save for retirement, making it an effective starting point. At Finomenon Investments, we simplify the process using software to run stress tests and Monte Carlo simulations to create financial plans tailored to each client’s needs. Despite its simplicity, Understanding the 4% Rule resonates because it provides clarity with a degree of confidence for retirement savings.

What Is the 4% Rule?

Understanding the 4% Rule is crucial for planning your retirement spending. This guideline suggests that you can withdraw 4% of your retirement savings each year, and your savings should last for about 30 years. For example, if you need $60,000 annually, multiply that by 25 (the inverse of 4%), which means you need to save $1.5 million.

Here’s how much you need to save for different annual income levels:

- $60,000 income: $1.5 million savings

- $80,000 income: $2 million savings

- $100,000 income: $2.5 million savings

- $120,000 income: $3 million savings

- $150,000 income: $3.75 million savings

- $200,000 income: $5 million savings

By Understanding the 4% Rule, you can set clear savings targets based on your desired retirement income.

How Does the 4% Rule Work?

The 4% Rule is based on historical data, particularly the “Trinity Study.” The study showed that withdrawing 4% annually (and adjusting for inflation) from a balanced portfolio of stocks and bonds offers a high probability that your savings will last 30 years.

At Finomenon Investments, we recognize that Understanding the 4% Rule is only the first step. We go further by working backward from your retirement goals to create distinct investment portfolios that address short-, mid-, and long-term cash flow needs.

Variables Impacting the 4% Rule

While Understanding the 4% Rule offers a great starting point, several variables can impact its effectiveness:

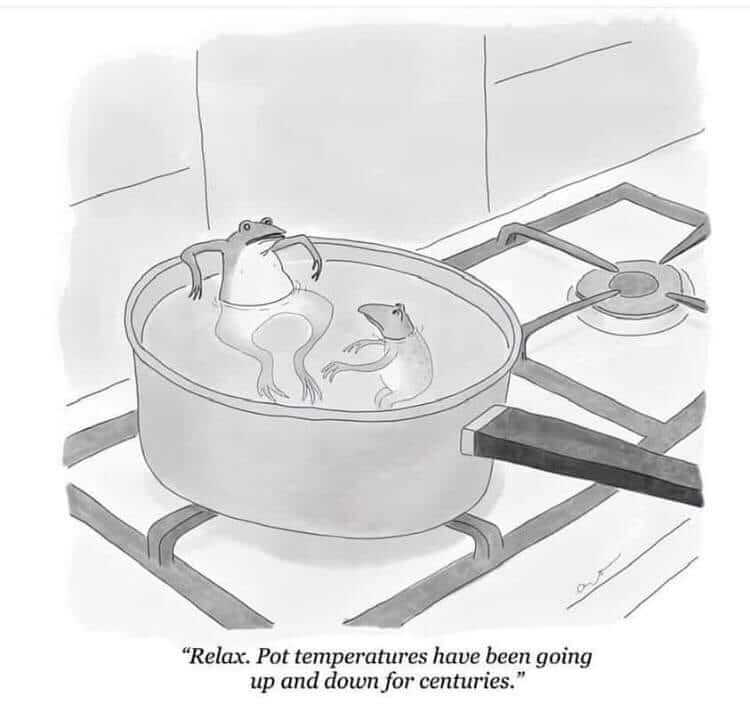

- Market Performance: Poor market performance in the early years of retirement can reduce the longevity of your savings. This risk, known as “sequence of returns risk,” underscores the importance of having a financial plan in place that accounts for market volatility.

- Inflation: Understanding the 4% Rule involves accounting for inflation, but unexpectedly high inflation, like what we’ve seen recently, can erode your purchasing power faster than expected.

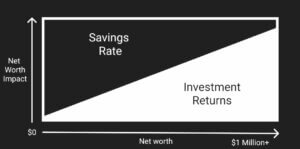

- Investment Strategy: The makeup of your portfolio impacts the sustainability of your withdrawals. A riskier portfolio may grow faster but with higher volatility, while a conservative one provides stability but lower returns.

- Life Expectancy: The 4% Rule assumes a 30-year retirement, but if you expect to live longer, you may need to withdraw less than 4%.

- Spending Flexibility: Understanding the 4% Rule assumes fixed spending adjusted for inflation, but real-life spending can vary greatly from year to year.

- Taxes: The rule doesn’t account for taxes, which can significantly reduce your net income depending on the types of accounts you withdraw from. At Finomenon Investments, we focus on a tax-efficient approach to maximize savings.

- Healthcare Costs: Health expenses typically rise as you age, so factoring in potential long-term care needs is essential. We encourage clients to utilize HSA accounts, which provide tax-free funds for medical costs, helping preserve your retirement savings.

Avoid Common Mistakes with 4% Rule

- Overspending: Once you’ve created a retirement withdrawal plan, it’s crucial to stick to it. If you anticipate spending more in retirement—whether it’s for travel, dining out, or other lifestyle changes—these should be factored into your plan from the start. Overspending beyond what you’ve accounted for can quickly deplete your 401(k) or retirement savings faster than expected, leading to financial strain in your later years.

- Taking Early Withdrawals: Withdrawing money from your 401(k) before age 59½ typically incurs a 10% penalty, along with taxes. This can severely impact your savings and reduce the amount you have available for retirement. Exceptions apply, but early withdrawals should be avoided whenever possible to protect your nest egg.

- Not Adjusting for Inflation: Failing to account for inflation can be a significant oversight. The cost of goods and services rises over time, and if you don’t adjust your savings and withdrawal strategies accordingly, you may struggle to meet your financial needs in retirement.

- Lack of Portfolio Diversification: At Finomenon Investments, a well-diversified portfolio is essential for managing risk in retirement. By investing in a mix of asset classes across various sectors, you reduce the likelihood of having to sell investments at a loss during market downturns. Diversification helps protect your retirement income from significant declines in any one part of the market.

Adjusting the Rule to Fit Your Needs

Understanding the 4% Rule is not a one-size-fits-all solution. Some retirees opt for a more conservative 3% withdrawal rate to account for market volatility and longer life expectancy, while others may start with 5% if they plan to reduce spending later. At Finomenon Investments, we stress-test multiple scenarios to help you find the most optimal path to your retirement goals.

By Understanding the 4% Rule, you can better estimate how much you need to save for retirement and make more informed decisions about your withdrawal rate. However, factors such as market performance, inflation, and personal circumstances can influence the rule’s effectiveness. Working with a professional financial planner can help ensure your strategy aligns with your goals.

Book a complimentary call with Finomenon Investments to help optimize your retirement strategy.

Disclaimer: This content is for informational purposes only and should not be considered investment advice. All investments carry risks, including the loss of principal. Finomenon Investments LLC cannot guarantee future results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.