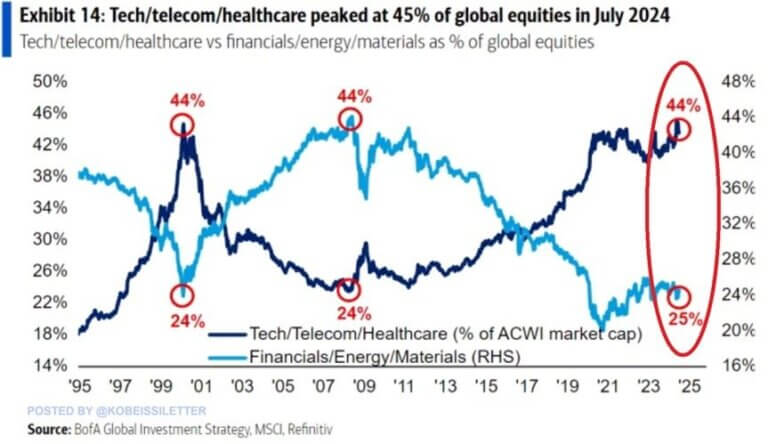

In July 2024, the concentration of technology, telecom, and healthcare sectors in global stocks reached a record 45%. This marks a significant rise of around 10 percentage points over the last four years, exceeding the previous all-time high of 44%, last seen during the 2000 Dot-Com bubble. Conversely, financials, energy, and materials as a share of global equities fell to 25%, slipping below their levels from the 2000 peak.

The accompanying chart visually emphasizes this shift, highlighting the divergence between the growth-oriented sectors and more traditional industries. The blue line illustrates how the tech/telecom/healthcare sector’s share peaked at 45% in 2024, echoing the 2000 Dot-Com era, while financials, energy, and materials dipped to 25%, their lowest level in decades.

During the Dot-Com era, after the bubble burst, tech, telecom, and healthcare stocks lost momentum for years, allowing financials, energy, and materials to regain prominence. Now, with market concentration once again approaching similar levels, the question arises: Will we witness a repeat of history?

With rapid advancements in AI, biotechnology, and 5G technology, the potential for continued growth in tech and healthcare remains significant. However, lessons from the past warn of the risks of unchecked exuberance and market imbalances. Interested in learning more? Speak to Shabrish about these insights and learn how a prudent risk management framework mitigates such risks.

Source: The Kobeissi Letter, BofA Global Investment Strategy, MSCI, Refinitiv

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.