When planning for retirement, many focus on chasing high returns, hoping their investments grow quickly and consistently. However, one often-overlooked factor that can significantly impact your portfolio’s long-term growth is the sequence of returns. Understanding this concept is crucial, especially for retirees who are drawing income from their investments.

What is the Sequence of Returns?

The sequence of returns refers to the order in which gains and losses occur in your investment portfolio. While the average annual return (AAR) tells you how your returns average out over time, it doesn’t reflect the greater impact of losses when they happen early or during withdrawals. Let’s look at an example. Imagine you invest $100,000 with the following returns over six years:

- Year 1: +40%

- Year 2: -30%

- Year 3: +40%

- Year 4: -30%

- Year 5: +40%

- Year 6: -30%

At first glance, the average annual return looks like a decent 5% (40% – 30% + 40% – 30% + 40% – 30%) = 30% / 6 years = 5% AAR.

But despite this positive average, your portfolio would only be worth $94,119.20 at the end of six years—less than you started with! How can that be?

In Investing, you often see a 6’ft man drowning in a river, which on average, is just 5’ft deep

– Howard Marks

The Impact of Compounding Losses

This discrepancy is due to the compounding effect of returns. Each year’s return builds on the portfolio’s value from the previous year. After Year 1’s 40% gain, your portfolio grows to $140,000. However, Year 2’s 30% loss is applied to this larger amount, reducing it to $98,000.

This shows why the order of returns matters just as much as the returns themselves. Losses hit harder, requiring greater gains to break even. For example, a 30% loss demands a 43% gain to recover fully.

Why Sequence of Returns Matters More During Retirement

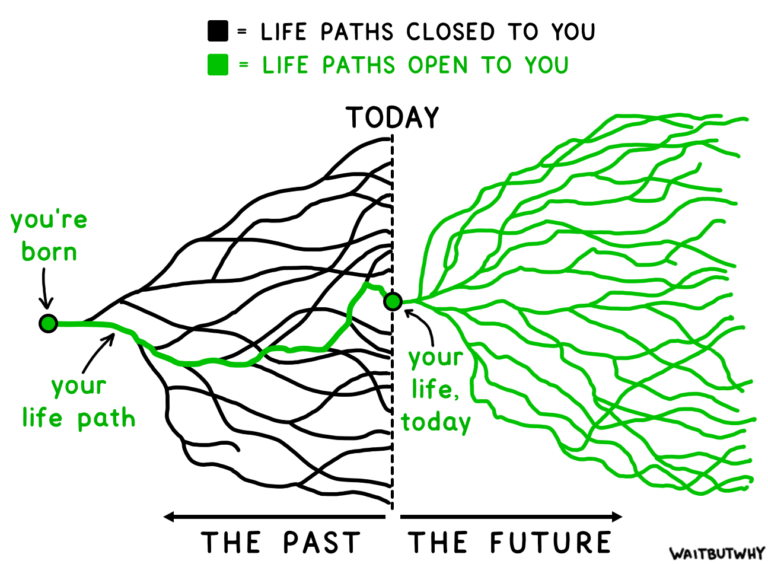

The sequence of returns is especially critical for retirees because they are withdrawing from their portfolios. If significant losses occur early in retirement while withdrawals are being made, it becomes far more challenging for the portfolio to recover.

Let’s compare two retirees, both starting with $1 million and withdrawing $50,000 per year:

- Retiree A: Experiences strong market returns early on.

- Retiree B: Faces early market downturns, followed by strong gains later.

Although both experience the same average annual return over 20 years, Retiree B is more likely to run out of money due to poor sequence of returns. Withdrawing from a declining portfolio locks in losses, leaving less to compound when the market recovers.

How to Manage Sequence of Returns Risk

While market performance is unpredictable, there are three key ways retirees can reduce the impact of sequence of returns risk:

- Diversify Your Portfolio: A diversified mix of stocks, bonds, and other asset classes can help buffer against market volatility. Bonds and fixed-income investments often perform more steadily, helping smooth out cash flows.

- Create a Cash Cushion: Keep a portion of your portfolio in cash or liquid assets to cover immediate expenses. This can prevent you from needing to sell investments during market downturns, allowing your portfolio time to recover.

- Use a Withdrawal Strategy: Employ strategies like the 4% rule or a variable withdrawal plan to avoid withdrawing too much during downturns. Adjusting withdrawals when the portfolio underperforms can help preserve your capital.

The sequence of returns can make or break a retirement plan, even with favorable average annual returns. When you’re withdrawing from your portfolio, negative returns early in retirement can have lasting effects. Planning for this risk is essential to help ensure your nest egg lasts. As you plan for retirement, focus not just on potential returns but also on safeguarding your portfolio from market fluctuations. Managing the sequence of returns risk is a crucial part of making your retirement plan more resilient.

At Finomenon Investments, we are building a client-obsessed family office with a strong commitment to fiduciary care and responsibility. If you want to learn more about how to prepare for your retirement, keeping your personal risk tolerance, goals and values in mind, Book Your Complimentary call today with Shabrish.

Disclaimer: This content is for informational purposes only and should not be considered investment advice. All investments carry risks, including the loss of principal. Finomenon Investments LLC cannot guarantee future results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.