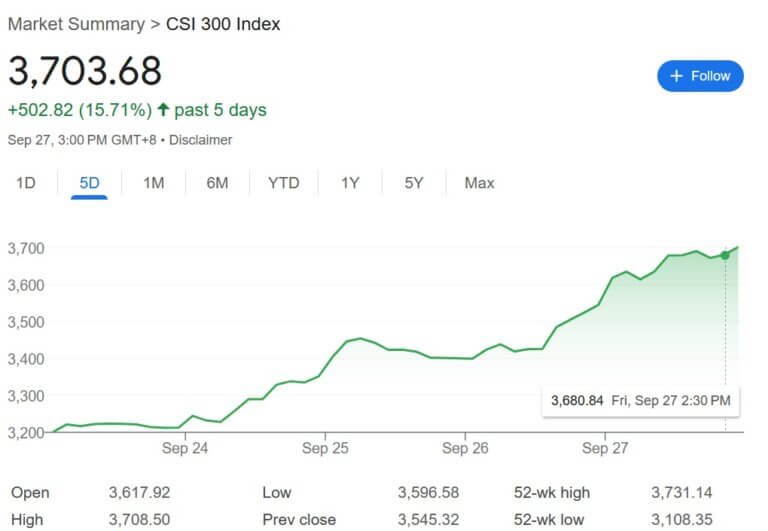

This past week, the Chinese stock market delivered a remarkable turnaround. The CSI 300 index surged 15% in just a few days, recovering all the ground lost since May and now up approximately 9% year-to-date. Tech stocks led the charge, with many trading at single-digit price-to-earnings (PE) ratios before this rally.

The Hang Seng Tech Index jumped 20%, with standout companies like JD.com surging by 35%.

So, what sparked this dramatic rise?

A major fiscal stimulus from the Chinese government seems to have revived investor confidence, especially in the tech sector. Many of these companies had reported strong Q2 earnings but were still weighed down by China’s broader economic struggles. Now, fund managers who had been underweight on Chinese equities are reversing course, increasing their exposure to the region’s stocks.

While it’s too early to declare a full recovery, China’s market shows clear signs of life. The combination of fiscal stimulus and attractive valuations is driving renewed interest. But the bigger question remains—will China continue to rely heavily on offshore capital to fuel its growth? HSBC’s “Under the Banyan Tree” podcast points to an interesting shift.

There’s nearly $1.8 trillion in time deposits sitting in Hong Kong and Singapore, suggesting that regional capital could be a major source of funding for the Asian markets moving forward.

Adding to the optimism, billionaire investor David Tepper recently expressed his bullish outlook on China during a CNBC interview, noting the potential in both the U.S. and Asian markets. Tepper’s insights have always been closely followed, and his recent stance on China could encourage more investors to take notice.

Commodities also saw a boost from the renewed optimism around China’s economy, particularly in metals like iron ore and copper. However, oil markets remained subdued. Initial price spikes following the stimulus news were tempered by Saudi Arabia’s decision to proceed with output hikes starting in December.

Key Takeaways

- CSI 300 Index Recovery: The Chinese stock market saw a 15% jump this week, recovering all losses since May and now up ~9% YTD.

- Tech Sector Gains: The Hang Seng Tech Index soared by 20%, with JD.com alone rising 35%, driven by major fiscal stimulus and attractive valuations.

- Investor Sentiment Shift: Emerging market fund managers, previously underweight on Chinese equities, are now increasing exposure as value opportunities emerge.

- Regional Capital Potential: With $1.8 trillion in deposits in Hong Kong and Singapore, regional capital could play a big role in fueling China’s market growth, reducing reliance on offshore capital.

- David Tepper’s Bullish Outlook: Influential investor David Tepper expressed confidence in China, adding to the positive sentiment around the market’s future potential.

- Commodity Impact: Metals like iron ore and copper rallied, while oil prices remained tempered due to Saudi Arabia’s output hike plans.

The week’s developments suggest China’s market is stirring, and continued attention will be on how these trends evolve. As we move into the coming weeks, all eyes will be on China’s next steps. Will this momentum continue? And how will global and regional capital flows shape the future of these markets? Stay tuned as the dragon stirs once again.

Image Credit: Google Finance

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.