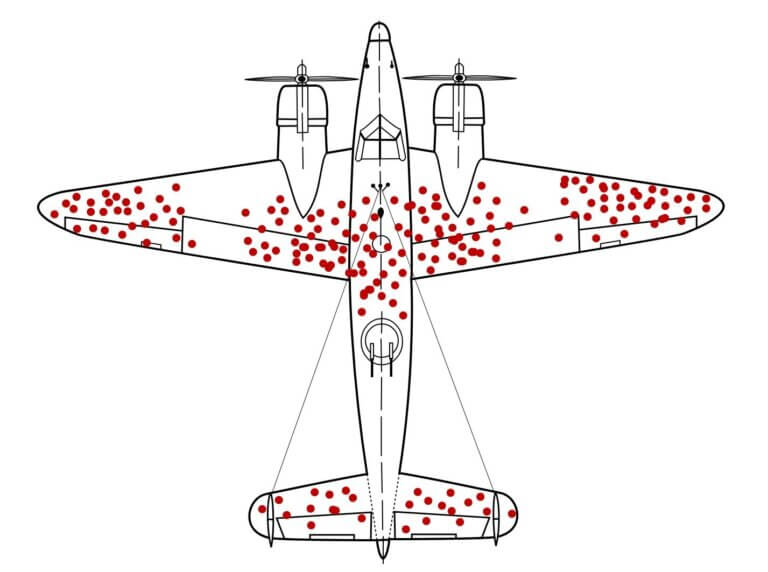

During World War II, U.S. military engineers analyzed bullet damage on returning aircraft to figure out how to reduce losses. Most of the damage was concentrated on the wings and tail, so the initial solution seemed clear—reinforce those areas. But statistician Abraham Wald saw things differently. He realized that the military was only studying planes that made it back, not the ones that were lost. His surprising insight: reinforce the engines instead. Planes hit in the engine didn’t return, and that’s why their damage wasn’t visible.

This shift in perspective illustrates survivorship bias, a cognitive error that’s just as relevant in investing as it was in military strategy.

Survivorship Bias in Investing: What Are You Overlooking?

Just like the military almost missed a critical piece of the puzzle, investors often focus only on the winners. When reviewing the performance of a mutual fund or a stock, you’re usually looking at the survivors—those that made it through market turbulence. But what about the investments that failed and disappeared?

Mutual fund performance is a prime example of survivorship bias in action. Managers often highlight their best-performing funds, conveniently ignoring those that were closed due to poor results. This creates a distorted view of success and can lead investors to believe it’s easier to pick winners than it really is.

Stock picking is another area where this bias lurks. Investors often celebrate companies like Tesla or Apple and think they can find the next big winner. However, they’re not seeing the dozens of companies that started with similar hype and fizzled out, leaving investors with heavy losses. These unseen failures are just as important to understanding the true risks of investing.

The Danger of the “Zuckerberg” Illusion

We all know the story of Mark Zuckerberg—the college dropout who founded Facebook and became a billionaire. It’s a story often used to inspire entrepreneurs. But what we don’t hear about are the thousands of others who dropped out of school, started a business, and failed. Survivorship bias paints a one-sided picture, and the same is true in investing.

When investors hear about stocks that skyrocketed, like Amazon or Netflix, they often forget the countless other companies that tried to replicate that success and crashed instead. This leads to overconfidence in stock picking, fueled by selective stories of success, while the failures are quietly brushed aside.

How to Avoid Survivorship Bias in Your Investments

To combat survivorship bias in your investment decisions, you need to actively seek out the full picture. Ask yourself:

- What’s missing from the data? Are you only seeing the funds that survived or the stocks that succeeded, while ignoring those that failed?

- What’s the broader market context? Is the success of the funds or stocks you’re evaluating dependent on a particular market environment?

- What role does luck play? Just like the returning planes, sometimes success is as much about timing and luck as it is about strategy.

Wald’s insight in WWII taught us that sometimes, what you can’t see is more important than what you can. The same holds true in investing.

Focus on the Unseen Risks

The key takeaway from this lesson is clear: don’t just focus on the winners. In investing, it’s easy to be swayed by the success stories, but you’ll gain a more accurate understanding of the risks and rewards if you consider the failures that never made the headlines. Just like the planes that didn’t return, the stocks and funds that failed are part of the bigger picture.

Before making your next investment decision, remember the lesson of survivorship bias. Look beyond the winners and ask yourself: What am I not seeing?

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.