The U.S. budget deficit is a longstanding concern for many Americans, given its implications for economic stability and long-term growth. Unlike other nations, the U.S. benefits from the dollar’s unique status as the world’s reserve currency, giving it flexibility to run deficits that might otherwise be unsustainable. However, this privilege isn’t a limitless resource, and relying on it excessively—especially during strong economic periods—carries substantial risks.

The Reserve Currency Advantage and Its Limits

The U.S. dollar’s role as the primary global reserve currency allows the U.S. to finance debt at low interest rates and unprecedented scales. This “reserve currency privilege” has enabled the U.S. to run significant deficits without immediate inflationary or currency crises. But dependence on global demand for U.S. dollars and Treasuries isn’t without its risks. If confidence in the dollar wavers, the U.S. could see rising interest costs and economic strain.

Full Employment and Persistent Deficits: A Risky Combination

Typically, deficits expand during recessions to stimulate the economy, not during periods of full employment. In recent years, the U.S. has run deficits even as employment reached historically strong levels. Persistent deficits under these conditions can strain resources, drive inflation, and limit the government’s ability to respond to future economic downturns.

The Federal Reserve’s Balancing Act

The Federal Reserve’s dual mandate—maximizing long-term employment and stabilizing prices—requires careful balancing to avoid destabilizing the economy. Through cautious rate adjustments and forward guidance, the Fed strives to set clear expectations without compromising its flexibility. Forward guidance, while helpful for setting market expectations, can limit the Fed’s ability to adjust quickly to new economic data. Maintaining “optionality” is essential to navigate uncertain times.

Structural Risks of Sustained Deficits

Running large deficits carries several risks:

- Increasing Interest Costs: Rising debt means higher costs to service it, especially as interest rates rise. This could divert funds from critical areas like healthcare and infrastructure.

- Reduced Flexibility for Future Crises: Deficits during stable periods limit options in future downturns, leaving less room for effective emergency responses.

- Dependency on Foreign Investors: Much U.S. debt is held by foreign investors, making the U.S. vulnerable if foreign demand weakens or global dynamics shift.

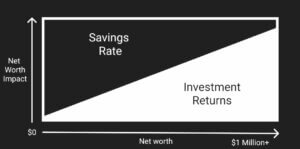

Sustainable Fiscal Management for Long-Term Stability

While the U.S. has managed significant deficits with the dollar as the global reserve, this approach may not be viable indefinitely. Structural adjustments and careful deficit management are essential to preserving economic stability. Proactive management today can ensure a stronger economic foundation for the future.

Time for a Balanced Approach

The U.S. budget deficit remains a complex issue, with unique opportunities and serious risks. With the dollar’s status providing unique flexibility, the U.S. has a choice: continue relying on this privilege or take steps now to secure a sustainable economic path. Balancing deficits responsibly, especially during periods of economic strength, will help ensure the U.S. remains resilient to future challenges.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.