1% AUM Fee

The 1% Assets Under Management (AUM) fee often becomes a lightning rod for criticism. Some argue it’s an expensive drain on a portfolio’s long-term growth. Others view it as an outdated model in an era where flat fees or robo-advisors offer alternatives.

But here’s the real question: does the cost of advice outweigh the benefits it provides?

Let’s dive into this debate, not just to address the criticisms but to help investors think critically about what they’re paying for—and why it might be worth it.

The Common Critique of AUM Fees

The criticism goes something like this: “A 1% AUM fee may sound small, but over decades, it compounds into a significant reduction in your portfolio’s value.” While this statement is technically correct, it often misses a crucial point, what clients gain from professional advice and why avoiding fees altogether can come at an even greater cost.

Consider this: without an advisor, how do most investors fare? Behavioral finance research shows that emotional decision-making, like panic selling during market downturns – can cost investors far more than 1% annually. Mistimed exits, poorly diversified portfolios, or missed opportunities for tax efficiency can erode years of diligent saving. A paper cut approach to retirement saving, withdrawals and risk management can cost you dearly.

Shifting the Focus: The Value of Comprehensive Advice

An advisor’s role isn’t limited to managing investments. A good financial advisor acts as a personal CFO, handling multiple aspects of a client’s financial life. Here’s where the true value emerges:

1. Preventing Emotional Mistakes

- The market’s highs and lows test even the most rational investors. Advisors step in as behavioral coaches, helping clients stick to their long-term plan.

- Example: During the 2020 COVID-19 crash, many retail investors sold at the bottom. Those working with advisors often avoided such losses.

2. Maximizing Tax Efficiency

- Tax strategies can often save clients more than the 1% fee itself. Think tax-loss harvesting, Roth IRA conversions, or charitable giving strategies.

3. Holistic Financial Planning

- Advisors often guide clients through complex decisions: estate planning, retirement income strategies, and even insurance coverage. These are areas where DIY tools or robo-advisors fall short.

4. Savings Beyond Investments

- A skilled advisor ensures clients are optimizing all parts of their financial life—not just their portfolio. This might include advice on 401(k) rollovers, mortgage decisions, or even college savings plans.

What is Cost of Advice?

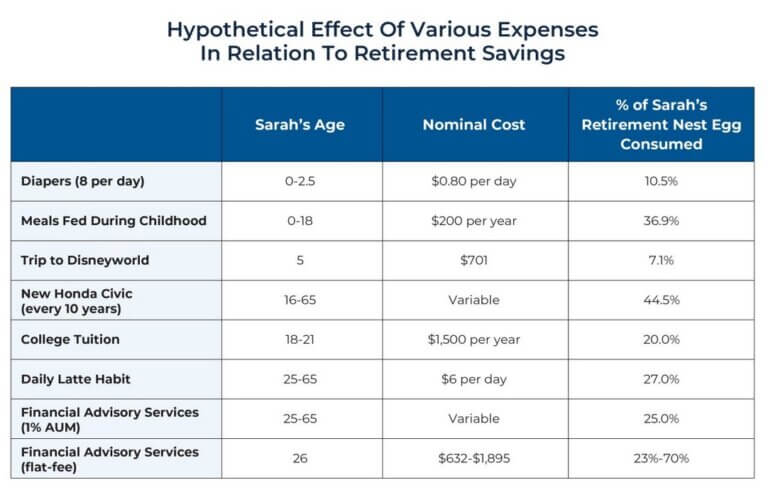

All spending, technically, reduces a person’s investable assets—this is true for a daily latte or a trip to Disneyworld. The real question is whether the spending adds value.

- Critics often forget this principle: The 1% AUM fee is not just a cost; it’s an investment in avoiding mistakes, gaining expertise, and achieving peace of mind.

- What about alternatives? Flat fees or hourly models may seem cheaper, but for those with growing portfolios, they often lack the ongoing, tailored guidance that AUM-based advisors provide.

Measuring Client Outcomes Rigorously

Imagine Sarah, a 35-year-old professional with a $500,000 portfolio. She’s skeptical of paying $5,000 annually in fees. Here’s the potential cost of DIY

- Behavioral Coaching: Avoids panic-selling during a 20% downturn, saving millions in potential losses. Avoids buying into the next shiny toy, buying at peak and selling at bottom of the euphoria.

- Tax Efficiency: Has $2.9M more in ending assets due to planned asset location and planned withdrawals i.e. reduced RMDs.

- Retirement Income Optimization: Adds $150,000 in annual tax free cash flows due to a well planned Roth conversion strategy.

In Sarah’s case, how does the advisor’s $5,000 fee pales in comparison to the value?

The “Fee Myth” Debunked

The argument that a 1% fee erodes portfolio growth often overlooks its primary purpose: enabling better decisions and outcomes. As Derek Tharp from Kitces.com highlights, “Advisors don’t just manage money they manage outcomes.” Instead of viewing fees as a drag on performance, consider them an investment in achieving financial goals with clarity and confidence.

It’s About Value, Not Just Cost

The 1% AUM fee will continue to face scrutiny in financial circles, and that’s okay, it keeps advisors accountable. But before dismissing it, investors should consider the bigger picture. When paired with a skilled advisor, the fee often pays for itself many times over, ensuring financial goals are met, emotions are managed, and wealth grows steadily over time.

Re-framing the Conversation

To address these concerns, it’s essential to re-frame the discussion around the holistic value of financial advice:

- Quantifying the Value of Advice: Advisors offer more than just investment management. They provide comprehensive financial planning, behavioral coaching, tax-efficient strategies, and estate planning. For instance, during market downturns, advisors can prevent you from making panic-driven decisions that could harm long-term financial health.

- Transparent Comparisons: While a 1% fee may seem substantial, it’s important to compare it to the potential costs of not having professional guidance. Mistimed market exits, inadequate diversification, or missed tax-saving opportunities can result in losses far exceeding the annual fee.

- Demonstrating Return on Investment (ROI): Advisors can showcase the tangible benefits they’ve provided to clients, such as achieving financial goals, optimizing retirement income, or navigating complex financial situations. These success stories can illustrate the real-world value of their services.

- Offering Flexible Fee Structures: To accommodate varying client preferences, advisors might consider alternative fee models, such as flat fees, hourly rates etc. This flexibility can help align the advisor’s compensation with the client’s perceived value.

If you’re weighing the cost of financial advice, ask yourself: can you afford not to have a guide on your financial journey? Speak to Shabrish and understand if you could benefit from personalized, commission free advice.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Kitces.com. Any Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.