At Finomenon Investments, we believe in a disciplined approach to investing, that prioritizes quality, patience, and risk management. Drawing inspiration from some of the world’s most successful investors like Warren Buffet, Howard Marks, Peter Lynch and others, we developed a framework that embodies their philosophy and ensures that investment decisions when buying individual stocks are perceptive.

In fact, many of our Clients understand and appreciate equities as an asset class because they have seen their wealth grow through their own equity compensation. This is true for most corporate managers who have at least spent four years or more at companies like Google, Microsoft, Nvidia, Amazon and Meta and other similar companies. While these companies clearly innovated products and services to deliver customer and shareholder returns, there are many others who delivered huge returns to shareholders over long periods.

Here are some key ideas that some of the best Investors use and a key to our investing approach.

1. Avoid Big Risks

- Turnarounds: Turnaround stories can be tempting, but the chances of a failing business successfully turning things around are slim. Stick to companies that have a consistent track record of success.

- Detect Debt: High levels of debt can cripple a company, especially during economic downturns. Focus on businesses with strong balance sheets and manageable levels of debt.

- Ignore M&A Junkies: Frequent mergers and acquisitions can signal a lack of organic growth and a high level of risk. Be cautious of companies that rely heavily on M&A activities. Most acquisitions don’t create the expected value and in most cases, SVAR (Shareholder Value at Risk) – a key M&A metric which presents synergy costs are underestimated.

- Avoid Predicting Uncertain Outcomes: Invest in stable, predictable industries rather than sectors subject to rapid change or unpredictability. This ensures your investment is less vulnerable to unforeseen market shifts.

2. Buy High Quality at a Fair Price

- Focus on High-ROCE/ROIC Businesses: Look for companies that consistently deliver a high Return on Capital Employed (ROCE). This indicates efficient capital allocation, strong management, and a sustainable competitive advantage. Companies that generate higher return on invested capital and grow faster by deploying fewer dollars.

- Be Price Sensitive: Only invest when the market offers attractive valuations. Paying a reasonable multiple (P/E ratio) for high-quality businesses is crucial for long-term success. Remember, the market rarely presents these opportunities, so be patient.

- Seek Convergent Patterns: Look for patterns of success in older, established industries, and avoid those where trends are unclear. Industries that show a clear convergence towards a dominant player or model are often safer bets.

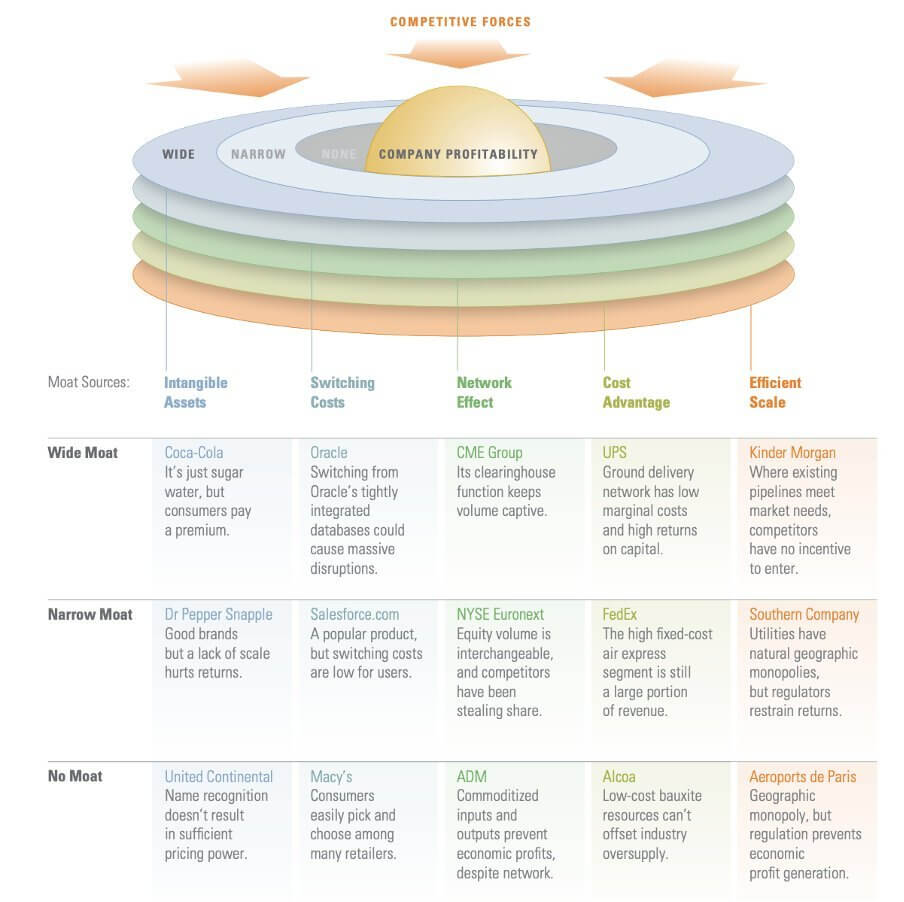

- Business Robustness AKA Moat: A robust business can withstand internal and external challenges, such as strategic shifts or economic downturns. Evaluate a company’s historical performance and its ability to adapt to changes. A company can have a variety of moats such as the ones illustrated below.

Source: Counterpoint Global

3. Focus on the Big Picture

- Buy Rarely, Hold Long: Capitalize on short-term market fluctuations to buy quality companies, but hold them for the long term. The real value of high-quality businesses becomes more apparent over time. The richest people in the world own businesses for long term. Imagine if Jeff Bezos would have cashed out a few years after IPO.

- Ignore Short-Term Noise: Market fluctuations, quarterly earnings, and day-to-day news should not dictate your investment decisions. Focus on the long-term fundamentals of a business.

- Sell Only on Fundamental Deterioration: Only consider selling if there is a significant negative change in a company’s fundamentals or management strategy. Otherwise, let your investments grow and compound over time.

At Finomenon Investments, we believe in a methodical and patient approach to investing. By avoiding big risks, focusing on high-quality businesses, and maintaining a long-term perspective, you can build a resilient and profitable investment portfolio. Successful investing is not about chasing the next big thing—it’s about staying disciplined, informed, and patient.

Image Credit: Pitchdeck Edits art print by Benjamin Schwartz

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results