Designing a compliant, employee-centered 401(k) plan is a rewarding process, empowering employees’ retirement goals while enhancing a company’s ability to attract and retain top talent. At Finomenon Investments, we advise clients on what robust 401(k) features should look like when evaluating career changes.

Here are some essential features we recommend for a strong employer-sponsored 401(k) plan:

1. Safe Harbor with Generous Matching

A solid 401(k) plan often includes a Safe Harbor provision with an employer match, such as 4%. This setup helps the plan meet IRS nondiscrimination requirements with ease, while also offering notable benefits to employees. A guaranteed match motivates employees to contribute, directly supporting their retirement savings.

2. Diverse Contribution Options: Pre-Tax, Roth, and After-Tax

A flexible 401(k) plan offers multiple contribution types—pre-tax, Roth, and after-tax—allowing employees to customize their retirement strategies based on personal financial needs and tax preferences. This enables individuals to either reduce taxable income now or plan for tax-free withdrawals in retirement.

3. In-Plan Roth Conversions and In-Service Distributions

A comprehensive 401(k) plan includes both in-plan Roth conversions and in-service distributions, catering to diverse retirement strategies:

- In-Plan Roth Conversions enable employees to convert existing pre-tax or after-tax contributions into Roth funds within the plan, optimizing tax management over time. At Finomenon Investments, we illustrate the compounded long-term benefits of Roth conversions with detailed projections of tax savings and growth.

- In-Service Distributions allow employees to withdraw a portion of vested funds while still employed, often after age 59½. These distributions can be rolled into a Roth IRA, enhancing tax planning and retirement income flexibility.

4. Profit Sharing Components

Adding a profit-sharing feature strengthens the retirement plan by linking employee contributions to the company’s financial performance. This not only boosts morale but aligns employees’ financial interests with the company’s success, fostering loyalty and shared goals.

5. Automatic Enrollment with Opt-Out Option

Automatic enrollment significantly increases participation rates, ensuring more employees are proactively saving. An opt-out clause maintains flexibility, but the default enrollment promotes a saving culture aligned with long-term financial security.

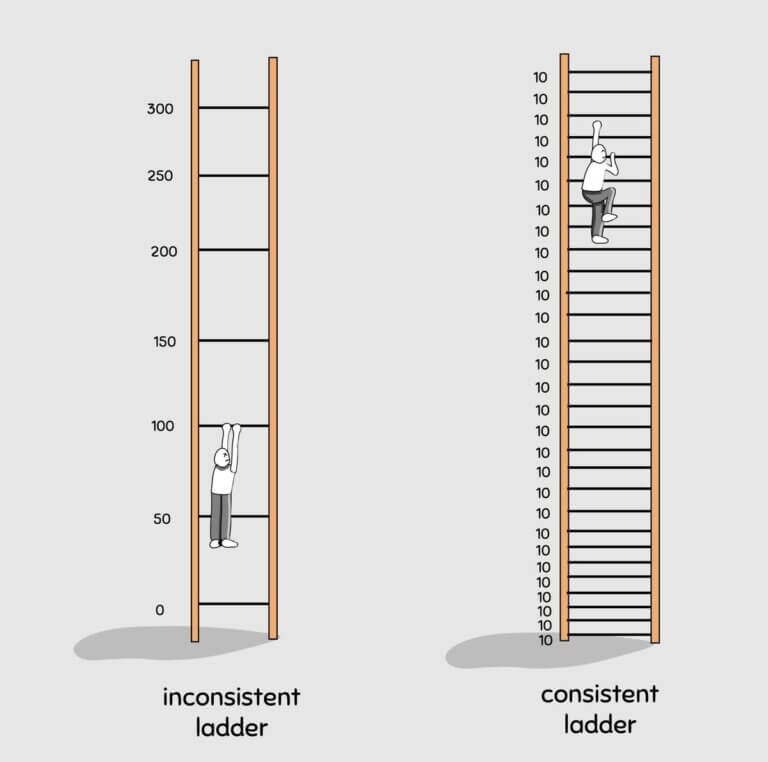

6. 1% Automatic Contribution Increases

Automatic contribution escalations—often around 1% annually—encourage employees to gradually increase savings without requiring action each year. This incremental approach can substantially boost their retirement fund over time.

7. Discretionary Matching

Discretionary matching enables companies to make additional contributions during profitable years, adding a valuable incentive for employees. This feature provides flexibility and is an effective way to reward performance and loyalty.

8. Brokerage Link for Expanded Investment Choices

Offering a brokerage link allows employees to access a broader range of investments, ideal for those seeking to manage their retirement portfolio actively. This option is attractive to investment-savvy employees, though we advise caution with broker-dealers who may push for excessive trading solely to generate fees. For guidance, consider reading our article or booking a consultation.

9. Favorable Vesting Schedules

A favorable vesting schedule gives employees full ownership of employer contributions more quickly, offering a tangible reward for their commitment. A common structure, such as a 4-year graded vesting, incentivizes employees to stay by rewarding loyalty.

Why These Features Matter

Integrating these elements into a 401(k) plan—automatic enrollment, diverse contributions, and strategic tax management—creates a robust and competitive retirement plan. Employers who prioritize these features not only meet compliance standards but provide valuable benefits that support their employees’ financial security, ultimately strengthening the organization.

Ready for Your Next Move?

If you’re transitioning to a new employer or evaluating retirement plans, connect with us for a free consultation to determine the retirement plan that’s right for you.

Image Credit: Images used are not created by Finomenon Investments; please share the source and author of any illustrations if known to ensure proper credit.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including potential loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.