In his most anticipated speech of the year, Federal Reserve Chair Jerome H. Powell made it clear on Friday that the central bank is likely to lower interest rates in September. As we edge closer to September 18, 2024, the anxiousness of the Federal Reserve’s first rate cut in this economic cycle is building. To understand what this might mean for the economy and markets, it’s helpful to look back at similar moments in history.

Two key dates stand out: January 3, 2001, and September 18, 2007. Both offer insights that help understand and appreciate what could potentially be the next outcome.

First Rate Cut in Fed Cycle: January 3, 2001

In early 2001, the Federal Reserve initiated a rate cut in response to signs of a slowing economy. What followed was a challenging period: the S&P 500 plummeted by nearly 39% over the next 448 days. At the same time, unemployment climbed by another 2.1%, reflecting the economic latency that often accompanies policy shifts. The market downturn and job losses were part of the broader fallout from the burst of the dot-com bubble—a harsh landing after years of growth driven by tech stock speculation.

First Rate Cut in Fed Cycle: September 18, 2007

In 2007, the situation was even more dire. The Fed’s first rate cut on September 18, 2007, marked the beginning of the Great Recession. Over the next 372 days, the S&P 500 tumbled by approximately 54%, and unemployment surged by an additional 5.3%. This period highlights the potential severity of economic latency—how the effects of monetary policy decisions can take time to manifest, often with significant consequences.

What to Expect After Sept 18th 2024?

Now, as we approach another potential rate cut on September 18, 2024, the question on everyone’s mind is whether history will repeat itself. Will we see a similar economic fallout, or have the lessons from past cycles better equipped us to handle the challenges ahead? The concept of the Fed’s landing—whether it’s a soft, hard, or bumpy landing—becomes crucial here. A soft landing, where the economy slows down without tipping into a recession, is the ideal scenario. However, history suggests that such outcomes are rare, particularly when economic latency is at play. The time lag between policy actions and their full impact on the economy means that even the best-intended moves can lead to unintended consequences. Relationship between policy effects are often non linear, mirroring how the capital market constituents themselves operate and behave.

What does all this mean at Finomenon Investments?

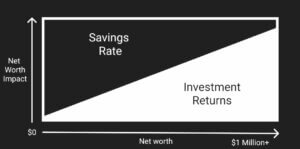

We see these historical patterns as clear lessons in finance around the essentials for managing risk. The previous rate cuts in 2001 and 2007 both led to substantial market declines, suggesting that caution might be warranted as we approach September 2024. Similarly, the potential rise in unemployment, as seen in the past, could signal broader economic challenges ahead. At Finomenon Investments, we build uncorrelated asset portfolios, structured based on anticipated cash flows.

As we await the Fed’s next move, staying informed and prepared for various scenarios will be key to navigating the uncertainties ahead. However, it’s important to remember that each economic cycle is unique. While the past offers valuable lessons, it doesn’t guarantee the future will unfold in the same way. This time, the Fed’s landing strategy and how it navigates the complexities of economic latency could be the critical factors that determine whether we experience another sharp downturn or a more controlled slowdown.

The historical precedent of past rate cuts serves as a stark reminder of the potential risks associated with monetary policy shifts. Whether September 18, 2024, leads to a repeat of past downturns or a more stable outcome, understanding the interplay of economic latency and the Fed’s landing strategy will be crucial. Investors brace for all possibilities, while remaining optimistic on long term outlook.

If you want to dive deeper and review how your assets are positioned to weather such passing storms, book a call today!

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.