Homeowners in California recently feeling the pinch as Allstate, one of the nation’s largest insurers, is set to increase home insurance rates by an average of 34.1%. This significant hike, reported by Bloomberg, is a stark reminder of the ongoing trend of rising insurance costs, which have become particularly acute over the past year. As insurance inflation continues to climb, it’s crucial to understand the implications of these increases for homeowners and the broader market.

The Rising Tide of Insurance Costs

The insurance industry has been grappling with a perfect storm of challenges, leading to substantial rate increases across the board. Several factors have contributed to the current situation:

- Increased Claims Due to Natural Disasters: With California facing more frequent and severe natural disasters, Allstate and other insurers are under pressure to cover the rising cost of claims. This drives the need for higher premiums to maintain financial stability.

- Inflation in Construction Costs: The sharp rise in construction costs, including materials and labor, means that when Allstate has to pay out claims, the amount required is much higher than in previous years. To adjust for these increased payouts, premiums must rise.

- Regulatory Environment: The regulatory landscape in California, where the state’s Department of Insurance must approve rate increases, might have caused delays in past rate hikes, leading to more significant jumps when finally implemented.

- Reinsurance Costs: Rising reinsurance costs, which are the expenses insurers incur to protect themselves from large losses, also contribute to higher premiums. Allstate likely faces higher reinsurance costs, which it passes on to policyholders.

Impact on Homeowners

For California homeowners, a 34.1% increase in home insurance rates is more than just a number—it’s a significant hit to the household budget. This rate hike could add hundreds, if not thousands, of dollars to annual insurance costs, depending on the value of the property and the specific coverage required.

Moreover, this increase comes at a time when many households are already dealing with higher costs for everyday essentials due to general inflation. The additional burden of higher insurance premiums could force some homeowners to reconsider their coverage levels, potentially leaving them under-insured and vulnerable in the event of a disaster.

While the situation may seem unfavorable, there are steps homeowners can take to mitigate the impact of rising insurance costs:

- Shop Around: It’s essential to compare rates from different insurers. Some companies may offer more competitive rates or discounts that can help offset the increase.

- Review Coverage Needs: Homeowners should review their policies to ensure they have the right level of coverage. It may be possible to adjust deductibles or coverage limits to reduce premiums without sacrificing essential protection.

- Bundle Policies: Many insurers offer discounts for bundling home and auto insurance. This can be an effective way to save on overall insurance costs.

- Invest in Mitigation: Some insurers offer discounts for taking steps to make a home more disaster-resistant, such as installing fire-resistant roofing or upgrading to earthquake-resistant features.

F2ON Partner MIIA Insurance has extensive experiencing in serving our Clients through Family Office. They do proactive price monitoring across thousands of insurance providers, generate quotes and present crystalized recommendations for Clients with varying combination of premiums and coverage. Explore the services and connect with them easily for a virtual consultation.

So Where Do We Go From Here?

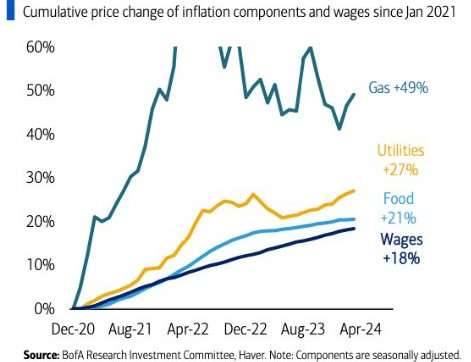

The sharp increase in Allstate’s home insurance rates in California is a reflection of broader trends in the insurance industry. As climate change, inflation, and other factors continue to exert pressure on insurers, homeowners should be prepared for the possibility of further rate hikes in the future and consider increased cost of home ownership in the coming years. This is why we call Inflation is a personal basket considering the constituents of PCI.

Staying informed, proactive, and flexible will be key to navigating this challenging environment. By understanding the factors driving insurance inflation and taking steps to manage their own costs, homeowners can protect both their properties and their financial well-being in the years to come.

The 34.1% rate hike by Allstate is a wake-up call for California homeowners, highlighting the growing challenges in the insurance market. As these pressures continue to mount, it’s more important than ever for homeowners to be vigilant and proactive in managing their insurance needs. With the right strategies, they can mitigate the impact of rising costs and ensure they are adequately protected against the unpredictable risks that lie ahead.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.