As a young professional, your biggest advantage in investing isn’t just your income – it’s time. The financial choices you make today will shape your future, and the key to long-term success isn’t chasing complex strategies or high-risk opportunities. Instead, it’s about consistency, patience, and applying time-tested principles.

Here’s a structured approach to guide your investment journey:

1. Define Your Risk Profile

Before you invest, understand your relationship with risk. Ask yourself:

- What are your financial goals? Are you investing for a home, early retirement, or financial independence?

- How much risk can you afford? Assess your cash flow, savings, and job stability to determine your risk capacity.

- What is your emotional tolerance for risk? Can you handle market volatility without making impulsive decisions?

- Try visualizing a 20% portfolio draw down and what it could do to your sleep?

As a young investor, your longer time horizon allows you to take on more risk. However, aligning investments with your emotional comfort ensures you stay committed, even during market downturns.

2. Align Investments with Your Timeline

Your investment horizon should dictate your strategy:

- Long-term goals (10+ years): Favor stocks and growth-oriented assets to maximize compounding.

- Short-term goals (3 years or less): Stick to stable, lower-risk assets like bonds or high-yield savings to protect against volatility.

By matching investments with your timeline, you balance liquidity for near-term needs while optimizing for long-term growth.

3. Optimize for Tax Efficiency

Where you invest matters as much as what you invest in. Structuring your portfolio for tax efficiency can significantly impact your returns:

- Tax-deferred accounts (401(k), IRA): Invest in high-growth assets where gains compound tax-free until withdrawal.

- Taxable accounts: Use tax-efficient investments like index funds and municipal bonds to minimize tax drag.

- Withdraw strategically: Plan withdrawals to optimize your tax liability over time.

A thoughtful tax strategy can help you keep more of your returns and accelerate wealth accumulation.

4. Diversify to Manage Risk

Diversification isn’t just about reducing risk—it’s about ensuring your portfolio isn’t reliant on a single outcome. Spread your investments across:

- Stocks: The engine for long-term growth.

- Bonds: Stability and income generation.

- Alternatives (real estate, commodities): Additional diversification to manage market cycles.

For young professionals, a higher allocation to equities makes sense, but rebalancing over time ensures your portfolio evolves with your goals.

5. Commit to Rebalancing

Market fluctuations can shift your portfolio’s balance, increasing exposure to certain assets. Regular rebalancing ensures your investments remain aligned with your strategy:

- Review your portfolio periodically.

- Trim overweighted assets and reinvest in underweighted ones.

- Stay disciplined—don’t let emotions drive allocation decisions.

Rebalancing enforces discipline and maintains a risk profile that fits your long-term vision.

6. Minimize Costs—Compounding Will Do the Heavy Lifting

Investment fees might seem small, but they compound over time and can eat into your returns. Keep costs low by:

- Choosing index funds and ETFs over high-cost mutual funds.

- Avoiding excessive trading fees and advisory expenses.

- Being mindful of expense ratios, ensuring they stay below industry averages.

Every percentage point saved on fees stays invested, fueling long-term growth.

7. Master the Psychology of Investing

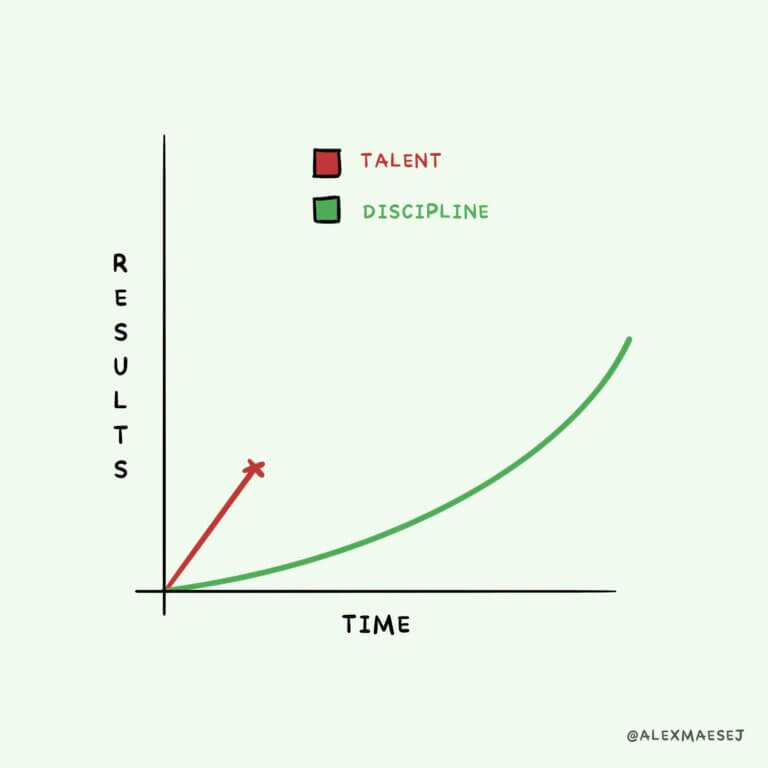

Investing is as much about behavior as it is about numbers. Emotional decisions—fear during downturns or greed during rallies—can derail even the best strategies.

- Ignore short-term market noise. Fluctuations are normal; focus on the long-term.

- Avoid panic selling. Selling at the wrong time locks in losses and disrupts compounding.

- Stay process-driven. Your plan is built for decades, not days.

The best investors aren’t those who pick the perfect stocks but those who stay the course through market cycles.

Keep It Simple and Stay the Course

Successful investing isn’t about chasing the next big thing – it’s about following a framework that stands the test of time:

- Understand your risk profile.

- Align investments with your timeline.

- Optimize for tax efficiency.

- Diversify and rebalance regularly.

- Minimize costs.

- Stay disciplined and avoid emotional reactions.

Time and compounding are your greatest allies. Stay patient, stay invested, and let the process work in your favor.

At Finomenon Investments, we combine deep financial expertise with behavioral discipline to help you stay on track for the long term. By prioritizing transparency, performance, and a client-first approach, we ensure your investment strategy is built for lasting success. Schedule a free consultation today!

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results