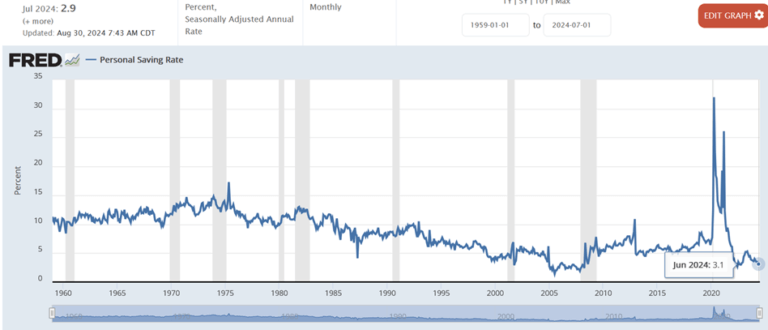

The current personal savings rate for consumers is at one of the lowest levels we’ve seen in a while, but this doesn’t necessarily spell bad news for the economy. In fact, some insights could actually be indicating the underlying cause of resilient economy, GDP growth, markets. Lets discuss these:

1. Consumer Spending is Still Strong

The primary reason behind the low savings rate is that consumers are still spending. When savings rates are high, it’s often a sign that consumers are tightening their belts, potentially out of fear of economic instability. In contrast, a low savings rate indicates confidence. Consumers are willing to part with their money, driving demand for goods and services. This spending is crucial because consumer spending accounts for a significant portion of GDP. As long as people continue to spend, the economy can continue to grow, which is why we’ve been seeing GDP growth rates above 2.5%.

2. Revenge Spending Continues

In 2020, personal savings rates surged as people stayed home, leading to reduced spending. While this increase in savings provided a financial cushion for many, it had a dampening effect on economic growth. The opposite is happening now—less money is being saved, but more is being spent. This is directly contributing to GDP growth. The logic is straightforward: when consumers spend more, businesses see higher revenues, which can lead to more hiring, investment, and production, all of which are positive for economic growth.

Many consumers are also parking their money in high-yield money market accounts or brokerage accounts that offer a 4-5% annual percentage yield (APY). These alternatives are far more attractive than the near-zero interest rates offered by traditional savings accounts at big banks.

The Bottom Line

While a low personal savings rate might seem concerning, it’s important to look at the broader picture. Consumers are still spending, which drives GDP growth. Moreover, the money that isn’t being saved in traditional accounts is likely being invested in ways that can yield higher returns, including in High Yield Savings Accounts. Far from being bearish, the current low savings rate continues to signal consumer confidence, which is positive for the economy.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.