They say that we learn by standing on the shoulders of the giants. We constantly look for leaders in the field of finance and investing, who set the benchmark, not in terms of investment returns alone but setting high standards in ethics and integrity and inspiring us with their investing and capital allocation framework. Here’s a breakdown of the 10 investing lessons from the legend Warren Buffet:

- Focus on Familiar Fields: Invest in what you understand, minimizing risk by sticking to what you know best. As your investment managers, we are always skeptical first and optimist later, never chasing the hot new thing.

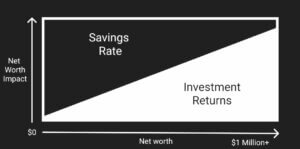

- Hold On to Winners: When an investment is performing well, let it grow instead of selling too soon, maximizing its potential gains and let compounding do its work. This is why Finomenon Investments considers cash flow needs anticipation as a key to capital allocation.

- Go Against the Grain: Don’t be afraid to invest where others hesitate; sometimes the best opportunities are found in contrarian thinking. Avoid herd mentality at all times.

- Invest in Your Best Ideas: Concentrate your investments on a few strong ideas rather than spreading your capital too thinly. Diversify but avoid di-worse-ifying!

- Spot Good Capital Allocators: Identify entrepreneurs who are good capital allocators and also catalysts for strategic changes or big shifts that can be big opportunities. Jeff Bezos, Steve Jobs, Zuckerberg or Gates – they all are capital allocators as much as they are entrepreneurs.

- Do Thorough Research: Dive deep into understanding any investment before investing, ensuring you’re well-informed. If things sound too good to be true, it might be just that!

- Take Bold Stances: Be willing to develop your thesis for an investment and don’t take pleasure in being with or against the crowd.

- Choose Strong Companies: Focus on businesses with solid fundamentals, strong brands, and promising growth prospects with long runway for growing customers, products and services.

- Seek Sustainable Advantages: Invest in companies that build and maintain a competitive edge, ensuring long-term success. Brand, Customer Loyalty, Technology, Scale – all are sustainable advantages.

- See the Future Potential: Look beyond what’s immediate, and think big picture and future possibilities, envisioning what it can become.

These reflect a disciplined approach to investing, emphasizing deep understanding, patience, and the courage to act on well-researched convictions. We have used them to guide our investment framework when creating portfolios for our clients and actively use them as our mental model.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.