$1.5 million today

-June 2024

That’s a powerful example of the long-term potential of investing in the stock market, especially in a broad index like the S&P 500. It really highlights the benefits of compound growth over time. Staying invested and being patient can yield significant returns, even if the market has ups and downs along the way. It’s a great reminder of the value of thinking long-term when it comes to investing!

Warren Buffett, one of the most successful investors of all time, often emphasizes the power of long-term investing. Reflecting on the growth potential of the S&P 500, he once remarked, “The stock market is designed to transfer money from the Active to the Patient.” This quote perfectly encapsulates the essence of investing in an index like the S&P 500, where time and patience are key to unlocking substantial gains. Buffett has also pointed out the importance of staying invested over the long haul, despite market fluctuations. He famously said, “Our favorite holding period is forever.” If someone had invested $10,000 in the S&P 500 in 1980 and simply let it grow, that investment would be worth nearly $1.5 million today.

This example underscores the wisdom in Buffet’s approach—it’s not about timing the market, but rather, spending time in the market.

Buffett’s advice has always been to invest in broad, low-cost index funds, like the S&P 500, for those who may not have the expertise or time to pick individual stocks. He said, “In my view, for most people, the best thing to do is own the S&P 500 index fund.” The impressive growth from 1980 to today is a testament to the strength of this strategy. For anyone looking to build wealth over time, this is a powerful reminder that consistent, long-term investing can yield remarkable results.

When Amazon shares plummeted alongside other tech stocks in 2000, Jeff Bezos sought to reassure concerned shareholders in his annual letter. Bloomberg journalist Jon Erlichman highlighted excerpts from the letter, where Bezos acknowledged the sharp decline in Amazon’s stock price but emphasized the company’s underlying strength. “Our shares are down more than 80% from when I wrote you last year. Nevertheless, by almost any measure, Amazon.com the company is in a stronger position now than at any time in its past,” Bezos stated, focusing on Amazon’s achievements in fiscal year 2000. This message was a testament to his belief in the company’s long-term potential, despite the short-term market turbulence.

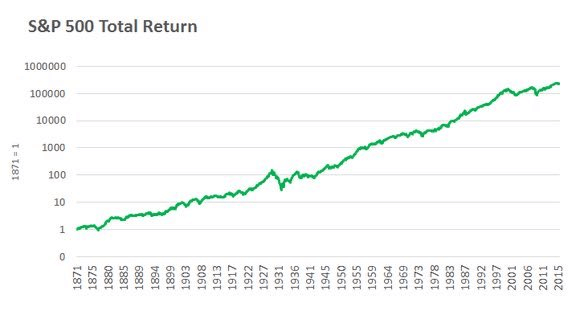

This chart below of the S&P 500 Total Return spanning from 1871 to 2015 demonstrates the incredible resilience and growth of the stock market over the long term. Despite the inevitable ups and downs, at every point in time, one could have argued that:

- The future was uncertain: There have always been reasons to worry, whether it was wars, economic recessions, or technological disruptions. Yet, the market continued to grow over time, rewarding those who stayed invested. This not magic but a scientific truth, the fundamental nature of how good companies and great managers continue to produce returns in excess of cost of capital is the reason why the chart shows a 45% angle in the long run.

- Inflation and Cost of Capital is high: This sentiment has been repeated throughout history, often unfairly. Yet, each generation has brought new ideas, innovations, and energy that have propelled economies and markets forward. Again, great capital allocators continue to do what they are good at.

- Politics were messing things up: Political decisions often cause market jitters, and it can seem like politicians are constantly making things worse. However, the long-term trend shows that the market has managed to thrive despite elections every 4 years, new policies and regulations.

Here are 5 key takeaways for investors

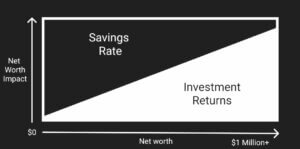

Focus on the Long Term: Market fluctuations are inevitable, but long-term investing historically leads to significant growth.

Stay Patient: Resist the urge to react to short-term market volatility. The power of compounding rewards those who stay invested.

Believe in Innovation: Each generation brings new ideas and technologies that drive economic progress, fueling market growth

Tune Out Noise: Noise can cause short-term disruptions, but the overall market trend has remained positive despite political, and economic fluctuations.

Ignore Doom and Gloom: There will always be reasons to fear the future, but history shows that markets recover and grow over time.

Data Source: Shiller (shillerdata.com)

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.