We have been asked this questions every election year, by every single one of our Clients. We understand why the Elections carry so much cognitive space in individuals because its self-reinforcing. Since media outlets continue to publish about Elections in overdrive, the wall street leaves no chance of making its own predictions and analysis and coming up with all sought of theories. The legendary Bond Investor Howard Marks argues that understanding Market cycles is far more critical for long-term investment success than trying to predict short-term market movements, such as those influenced by elections. Market Cycles drive the long-term trajectory of economic and financial outcomes and Elections, while important, are just one of many factors that can affect markets. Although, their impact is often temporary.

Markets are simply nonpartisan

Markets are more influenced by broader economic fundamentals and the stages of the cycle than by any single event, such as an election.

In Howard Marks’ book “Mastering the Market Cycle: Getting the Odds on Your Side,” he outlines the different stages of market cycles. Marks emphasizes that understanding these stages is crucial for investors because markets are cyclical and often driven by investor psychology, rather than just fundamental factors. Here’s a simplified breakdown of the stages:

Howards Marks: Mastering the Market Cycles

Recovery (Stage 1): This is where the market starts to recover from its lows. Investor sentiment begins to shift from pessimism to cautious optimism.

Early Expansion/Transition (Stage 2): The market continues to improve, moving from low to mid points. Economic indicators often start to turn positive, and the general outlook improves.

Growth/Swing to Upper End (Stage 3): The market gains momentum, with increasing confidence pushing prices higher. Optimism prevails, and the market moves toward its upper limits.

Peak (Stage 4): The market reaches its highest point. Optimism is widespread, and valuations often reflect perfection. This is typically the most dangerous point for investors.

Correction (Stage 5): After the peak, the market corrects, pulling back to more sustainable levels. This stage reflects the market’s recognition that prices have overshot realistic expectations.

Overcorrection (Stage 6): Sometimes, the market overshoots on the downside, falling below fair value due to excessive pessimism or panic.

Trough (Stage 7): The cycle bottoms out, setting the stage for the next recovery.

Howard Marks argues that understanding these cycles is far more critical for long-term investment success than trying to predict short-term market movements, such as those influenced by elections. Elections, while important, are just one of many factors that can affect markets, and their impact is often temporary. Markets are more influenced by broader economic fundamentals and the stages of the cycle than by any single event, such as an election.

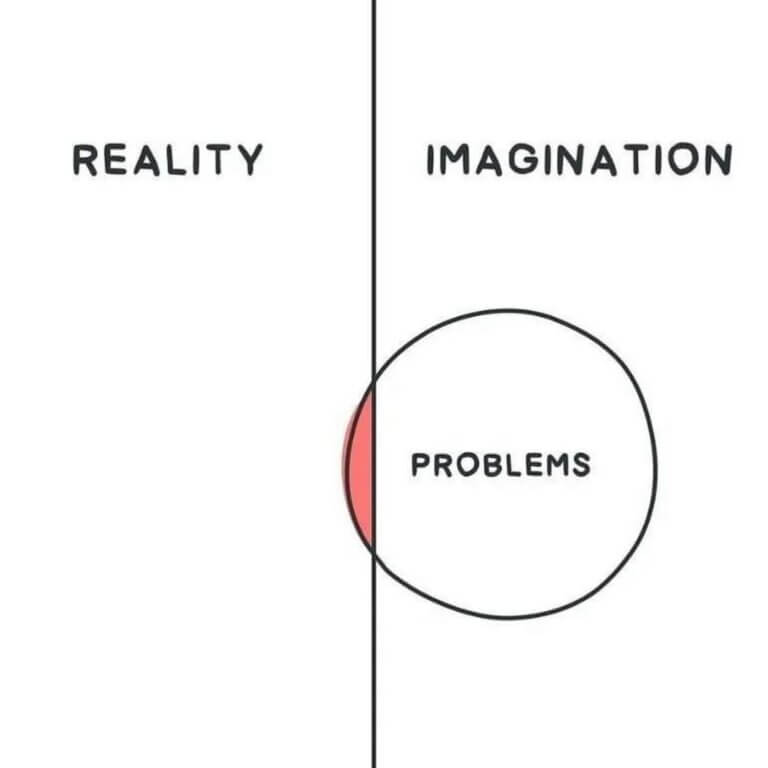

This visual representation aligns with Marks’ teachings, underscoring the importance of sticking to a disciplined investment process rather than reacting emotionally to market fluctuations. Elections, while often perceived as significant events, are just one of many factors that can influence short-term market movements. However, the market’s response to elections is typically fleeting, driven more by sentiment than by fundamentals. Long-term success in investing is better supported by understanding where the market stands within its broader cycle and maintaining a steady, process-driven approach, rather than attempting to time the market based on election outcomes or other short-term events.

In the short run, markets may react to election outcomes, but these reactions are typically based on sentiment rather than substance. Over time, the market’s focus shifts back to economic indicators, corporate earnings, interest rates, and the natural progression of the market cycle. Therefore, trying to time the market based on election outcomes is generally not a sound investment strategy. Instead, understanding where the market stands within the broader cycle, as Howard Marks advises, provides a more reliable framework for making investment decisions.

Historically, the impact of elections on the stock market has often been short-lived, aligning with the points made by Howard Marks. For instance, while markets may react with volatility around election results—whether due to uncertainty, optimism, or fear—these reactions are typically temporary and driven more by sentiment than by substantive changes in economic fundamentals. The U.S. presidential elections, for example, have seen markets swing in both directions immediately following results, but over time, broader economic cycles and factors such as corporate earnings, interest rates, and global events have played a much more significant role in determining market direction. This reinforces Marks’ argument that the real determinant of long-term market performance is the cyclical nature of markets, not short-term events like elections. Investors who focus on understanding where the market is within its broader cycle are better positioned for success than those who try to time the market based on election outcomes.

What are we telling our Clients at Finomenon Investments?

- It seems logical to expect election-year uncertainty to significantly affect market sentiment and performance.

- Historical data does not support this assumption. Instead, markets have typically continued to rise during election years.

- It’s crucial to remember that markets are nonpartisan.

- Portfolio positioning should be guided by a long-term investment plan rather than reacting to current events like elections.

Long term thinking has always been a key business tenet at Finomenon Investments, and we use them as our guiding principle.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.