Maximizing Retirement Wealth with Roth IRA Conversions

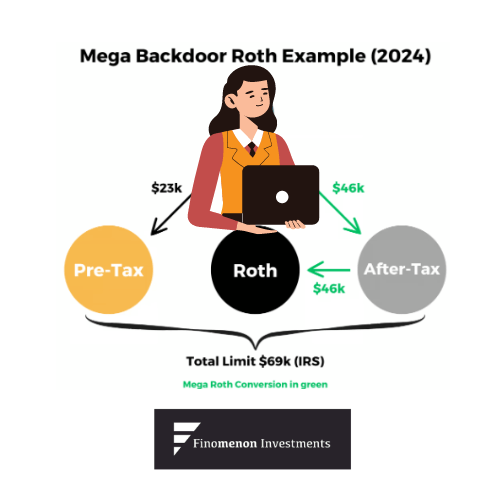

High-income earners often encounter challenges when planning for retirement, especially due to Roth IRA contribution limits. However, Roth IRA conversions present a powerful strategy to overcome these hurdles, allowing for tax-free growth and significant wealth accumulation over time. The illustration here shows $23k (employee deferral limit) applies to pre-tax contributions, and the remaining room up to $69k is for after-tax contributions, including employer contributions.

The Benefits of Roth IRA Conversions

Roth IRAs offer notable advantages, such as tax-free growth and withdrawals. Although direct contributions are restricted by income, conversions from a traditional IRA to a Roth IRA can be made regardless of income level.

Consider this scenario: An executive converts $46,000 from a traditional IRA to a Roth IRA in Year 1 (net post paying ordinary income tax). Assuming an average annual return of 7%, the account’s potential growth over time can be substantial. The following table illustrates the projected growth of this conversion over 30 years:

| Year | Starting Balance | Annual Growth (7%) | Ending Balance |

|---|---|---|---|

| 1 | $46,000 | $3,220 | $49,220 |

| 5 | $61,538 | $4,307 | $65,845 |

| 10 | $86,332 | $6,043 | $92,375 |

| 20 | $169,754 | $11,883 | $181,637 |

| 30 | $333,984 | $23,379 | $357,363 |

By Year 30, the balance could grow to approximately $357,363, all tax-free. This growth highlights the potential benefits of Roth IRA conversions.

Advantages for High-Income Earners

- Tax-Free Growth: Roth IRAs provide tax-free growth, which is ideal for long-term wealth accumulation. This strategy can reduce your lifetime effective tax rate and is a key metric we measure with your F2ON CPA. Learn more about F2ON here.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require RMDs during the account holder’s lifetime. This feature allows uninterrupted growth and greater flexibility in retirement planning.

- Estate Planning Benefits: Roth IRAs can be a valuable estate planning tool, allowing you to pass wealth to heirs tax-free. Beneficiaries can benefit from tax-free growth, though they must deplete the account within 10 years under current laws.

- Hedge Against Future Tax Increases: Executives anticipating higher taxes in retirement can use Roth IRA conversions to lock in current tax rates, thus hedging against future tax increases.

Key Considerations for High-Income Earners

- Tax Implications of Conversion: Converting a traditional IRA to a Roth IRA is a taxable event. The amount converted is added to your taxable income for the year, potentially pushing you into a higher tax bracket. At Finomenon Investments, we weigh the benefits of conversion against individual tax circumstances. In some cases, paying taxes on the conversion can be advantageous, as the assets become tax-free post-conversion. Tracking tax-deductible portions in your 401(k) is also crucial based on IRS pro-rata rules.

- Proactive Planning: To manage the tax impact, consider spreading conversions over multiple years. Ensure you have cash available to cover taxes without dipping into the IRA itself. Your advisor at Finomenon Investments will discuss this strategy extensively during the annual planning meeting with F2ON CPA. Learn more here.

A Notable Success Story

In 2010, Max Levchin, co-founder of PayPal and chairman of Yelp, sold 3.1 million shares of Yelp through his Roth IRA, earning approximately $10.1 million. Normally, such a profit would be taxable, but Max faced no tax liability due to his Roth IRA.

For high-income executives, a Roth IRA conversion can be a strategic move for securing a tax-free retirement. By converting traditional IRA funds and leveraging the tax-free growth of Roth IRAs, you can significantly enhance your retirement portfolio. With careful planning and consideration of tax implications, this strategy can play a vital role in achieving your long-term financial goals.

Ready to Learn More?

Want to see how you can turn your current retirement savings into a powerful, potentially tax-free asset? Book a call today or click here to learn more.

Disclaimer: This information is not investment advice. All investments carry risks, including possible loss of principal and fluctuations in value. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.