Maximizing Health Savings Accounts (HSAs): A Strategic Tool for Corporate Managers and Executives

Health Savings Accounts (HSAs) are one of the most powerful tools for corporate managers and executives looking to save, invest, and prepare for future healthcare expenses in a tax-efficient manner. Unlike 401(k) or IRA plans, HSAs offer flexibility by not having required minimum distributions (RMDs). This makes them especially attractive to individuals with significant disposable income who want to maintain control over their funds. Furthermore, HSAs differ from Flexible Savings Accounts (FSAs) because they allow balances to roll over year after year—no “use-it-or-lose-it” policy. In many ways, HSAs function as long-term investments.

In 2023, HSAs held over $116 billion in assets across 36 million accounts, a remarkable 500% increase since 2013, according to the Consumer Financial Protection Bureau (CFPB). This growth reflects the increased enrollment in high-deductible health plans (HDHPs), a requirement for opening an HSA.

Leveraging the Triple Tax Advantage

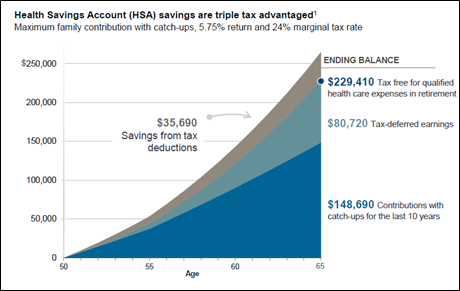

One of the most compelling reasons for high-income individuals to prioritize HSAs is the “triple tax advantage.” Contributions to HSAs are made with pre-tax dollars, reducing taxable income. Furthermore, the funds within the account grow tax-free, and withdrawals for qualified healthcare expenses are also tax-free. This combination makes HSAs one of the most tax-efficient vehicles available today.

For corporate managers and executives who often transition between employers, HSAs offer additional flexibility. Like a 401(k), an HSA is portable, meaning it stays with you even if you change jobs. You can maintain the account with your current financial institution or roll it over into a new employer’s HSA plan.

HSAs as a Long-Term Investment Vehicle

High-income professionals often max out contributions to their 401(k) and IRA accounts. For those seeking additional tax-advantaged investment opportunities, HSAs can be a great option. In 2024, the IRS has set HSA contribution limits at $4,150 for individuals and $8,300 for family coverage under a high-deductible health plan.

If your cash flow allows, you can contribute to your HSA, invest the funds, and let them grow over time. This strategy can be particularly advantageous when planning for healthcare expenses in retirement. Over 10 to 20 years, consistent contributions and wise investments can result in a substantial healthcare fund.

Healthcare costs in retirement can be daunting. According to Fidelity, the average retiree will need about $165,000 to cover healthcare expenses in retirement. High earners can strategically use HSAs to build a tax-advantaged reserve for these future costs, ensuring financial security later in life. The following illustration demonstrates how HSAs can support your long-term financial goals.

Strategic Use of HSAs for High Earners

For those with significant income streams, HSAs provide a unique opportunity to save for future medical expenses while enjoying tax-free growth. The ability to contribute without needing to use the funds immediately makes HSAs a powerful tool for long-term financial planning. Over time, they can even serve as a tax-free income stream during retirement, helping to manage taxable income levels.

In addition to covering standard medical expenses, HSAs can also be used for out-of-network healthcare services, which are often of concern for high earners seeking specialized or elective treatments. For example, HSA funds can be used to cover expenses like ongoing physical therapy, acupuncture, or wellness treatments that may not be covered by traditional insurance plans.

Considerations for High Earners

At Finomenon Investments, we start by conducting a thorough cash flow analysis to help clients understand their surplus cash after maximizing contributions to other tax-advantaged accounts. High earners have the distinct advantage of using HSAs to grow their wealth tax-free while also saving for retirement healthcare expenses. By integrating HSAs into their broader financial plan, we assist clients in optimizing their workplace compensation and benefits.

For corporate managers and executives, HSAs present a valuable opportunity to enhance savings, investment growth, and tax efficiency. Through careful contribution strategies, tailored investment plans, and fee management, HSAs can grow into a significant, tax-advantaged resource for future healthcare needs. It’s important to remember that health savings accounts are the only type of account that offers a triple tax advantage. While retirement accounts such as 401(k)s and Roth IRAs provide tax benefits, they don’t offer the same advantages on both contributions and withdrawals.

Book a Complimentary Call with Shabrish to learn more about your workplace benefits.

Disclaimer: This information is for educational purposes only and should not be considered investment advice. All investments carry risks, including potential loss of principal. Finomenon Investments LLC does not guarantee future financial results.