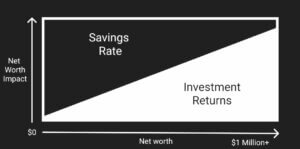

Good investing is all about assigning probabilities to various scenarios and assessing the odds. Position sizing plays a pivotal role in maximizing returns and managing risk. Determining how much of a portfolio to allocate to a single investment isn’t just about gut instinct. Instead, it involves a structured approach that considers conviction and certainty in projected outcomes.

Here’s how these components come together to shape smart position sizing decisions.

1. Understanding Position Sizing and Expected Returns

Position sizing refers to how much capital is allocated to a particular investment. It balances the need to maximize returns while minimizing risk. Central to this is the concept of expected returns, which are the weighted average of potential outcomes based on two key factors.

Two key factors that influence expected returns:

- Degree of certainty: How predictable an investment’s outcomes are.

- Level of conviction: How strongly you believe in your investment thesis.

2. Certainty: The Foundation of Expected Returns

Certainty is the confidence in predicting an investment’s future performance. The more predictable a company’s factors are, the higher the certainty, reducing the risk of unforeseen losses.

Key Drivers of Certainty

a. Business Model and Fundamentals

Companies with predictable cash flows and recurring revenue streams offer higher certainty. For example, subscription-based models (like SaaS) provide more predictable revenue than cyclical businesses like commodities. Defensibility is another great example which can drive certainty, this refers to a business moat such as brand, network effects, entry barriers, switching costs etc.

b. Competitive Landscape

A company operating in an industry with few competitors (e.g., Visa, Mastercard) tends to have more predictable earnings than those in hyper-competitive markets. Less threat from disruptive technologies also adds certainty.

c. Valuation and Margin of Safety

Buying a company at a discount to its intrinsic value provides a margin of safety, reducing downside risk. Low valuations relative to intrinsic value offer more room for error, increasing certainty.

d. Financial Health: Liquidity and Debt Levels

Companies with strong balance sheets and manageable debt levels provide higher certainty. Liquidity ensures resilience in short-term shocks, while low debt reduces financial distress risks.

3. Conviction: Belief in Your Thesis Impacts Position Sizing

Certainty relates to the predictability of outcomes, while conviction is about how strongly you believe in your investment thesis. Low conviction, even in high-certainty situations, should lead to conservative position sizing.

What Drives Conviction?

a. Deep Research and Understanding

Thorough research builds conviction. Confidence in your research about a company’s management, strategy, and competitive edge increases your belief in potential upside.

b. Catalysts for Growth

Identifiable catalysts, such as new product launches or favorable regulatory changes, drive conviction. The more tangible these catalysts, the higher the conviction.

c. Track Record of Execution

A management team with a solid execution track record boosts conviction. Conversely, frequent missteps should lower your confidence.

4. Blending Certainty and Conviction for Position Sizing

Position size should reflect both certainty and conviction, guiding you toward the right balance for each investment.

High Certainty + High Conviction = Large Position

Investments that exhibit both high certainty and high conviction should be major portfolio components. These investments carry low risk with strong potential upside.

High Certainty + Low Conviction = Moderate Position

High-certainty but low-conviction investments are low-risk but may not offer significant upside. Moderate position sizing suits these investments.

Low Certainty + High Conviction = Cautious Position

While conviction may be high for these higher-risk investments, low certainty suggests a cautious approach with smaller allocations.

Low Certainty + Low Conviction = No Position

These investments pose high risks with low upside. They should be totally avoided.

Position Sizing: Art or Science?

Position sizing is a delicate balancing act between certainty and conviction. By carefully weighing the predictability of future returns and your confidence in an investment thesis, you can optimize your portfolio to maximize returns while minimizing risk.

At Finomenon Investments, we blend research, disciplined risk management, and thoughtful position sizing to create long-term value for our clients. Our investment approach is grounded in certainty and conviction, ensuring every portfolio decision aligns with individual risk profile and goals.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.