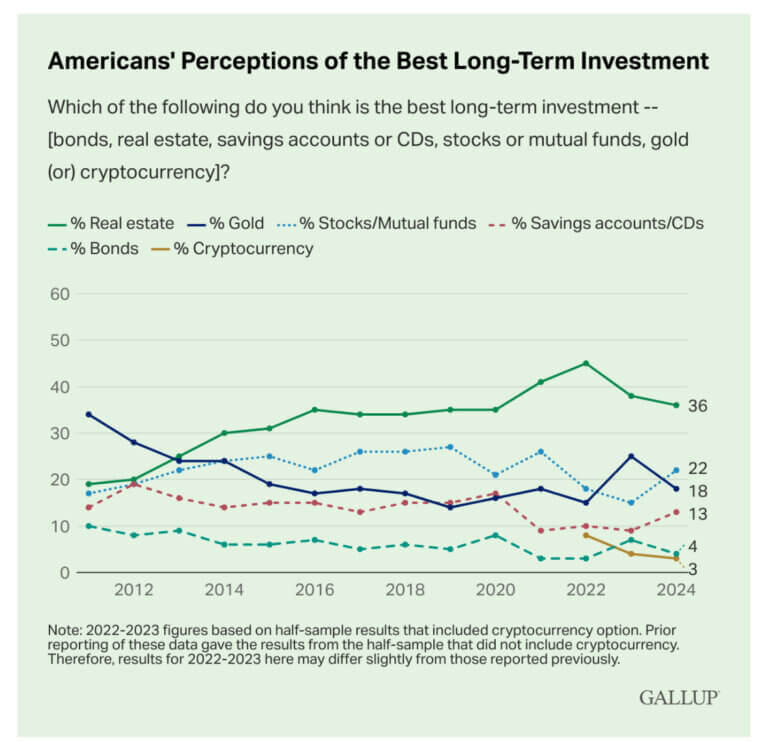

Every year, Gallup surveys Americans about what they believe is the best long-term investment. For more than a decade, one option has consistently topped the list: real estate. According to Gallup’s 2024 survey, 36% of respondents chose real estate as the best long-term investment, outpacing stocks (22%), gold (18%), and bonds (13%).

With so many investment options — from stocks to bonds, and gold — why does real estate remain the favorite for so many Americans?

Here’s a closer look

1. The Emotional Connection to Home-ownership

Owning a home is more than just a financial decision — it’s part of the American Dream. A home represents stability, pride, and success, making the emotional component crucial to understanding why so many view it as their most valuable asset.

For most individuals, their home is the largest purchase they’ll ever make and often their biggest financial asset. This psychological anchor means a home’s value isn’t just monetary; it’s deeply tied to personal success.

2. Real Estate’s Resilience After the Housing Crash

One of the most remarkable aspects of real estate’s popularity is how quickly it bounced back after the 2008 housing crash. Despite the worst housing crisis in modern history, real estate regained its spot as the top long-term investment by 2013 and has held that position ever since.

This rebound underscores real estate’s resilience. By contrast, stock market volatility during this period was starkly visible. According to Professor Aswath Damodaran’s data, the S&P 500 experienced 11 years of negative returns since 1980, with an average annual return of 9.8%. While stocks have performed well over time, their volatility and frequent downturns make them less attractive to risk-averse investors.

3. The Illiquidity Advantage

Real estate’s appeal also lies in its illiquidity. Unlike the stock market, where prices fluctuate in real-time, home values don’t change on a daily basis. This “out of sight, out of mind” quality allows homeowners to view their investment as stable and long-term, without the anxiety of tracking every market dip.

In contrast, stock market investors can follow every tick of a stock’s price, which, while offering transparency, can create stress during market downturns. At Finomenon Investments, we often say this, the illiquidity element of Real Estate perhaps gives this asset class the longest runway when it comes to uninterrupted compounding.

4. Lower Perceived Volatility

Historically, the housing market has seen fewer significant downturns. Over the past 75 years, the U.S. housing market experienced price declines in only 7 years — five of which occurred after the 2008 bubble burst.

By comparison, the S&P 500 has been negative in 22% of years since 1950 and has endured 10 bear markets and six crashes. Real estate, having experienced just one major crash during this time, is perceived as a safer, less volatile investment.

5. A Necessity and an Investment

Real estate is unique because it’s both a basic necessity and an investment. People need a place to live, and for many, owning a home allows them to invest in something tangible that provides utility while appreciating over time.

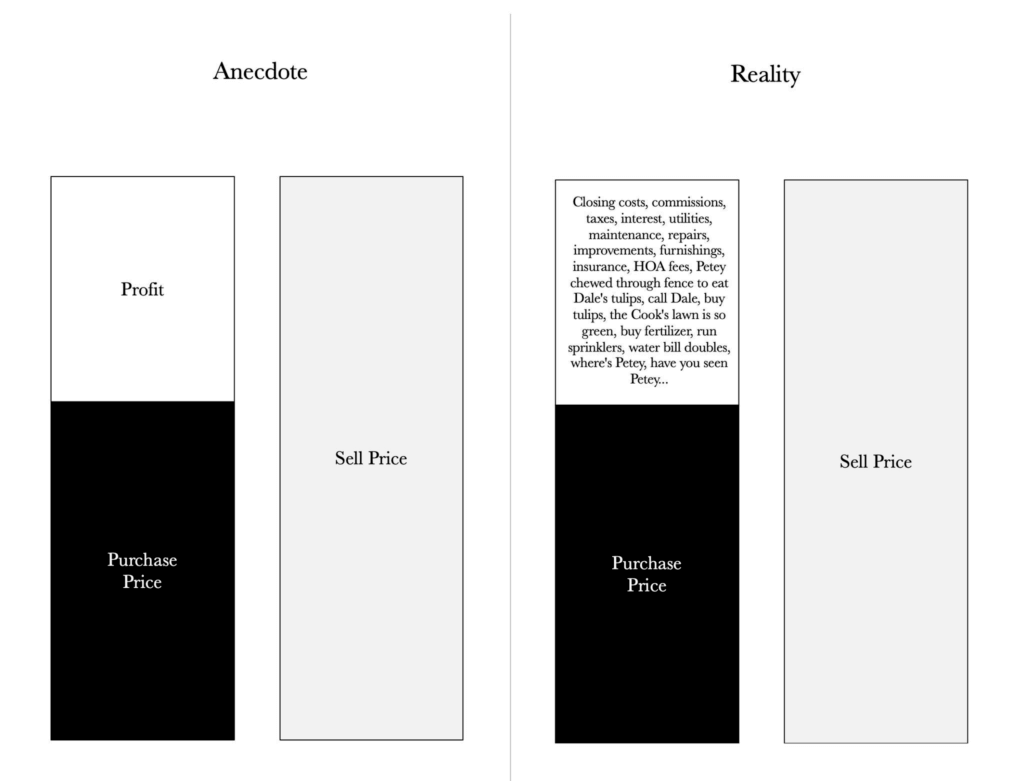

Although real estate comes with additional costs like property taxes, maintenance, and insurance, many homeowners simplify their return on investment (ROI) by comparing the purchase price to the eventual sale price. This calculation often overlooks the ancillary costs, but it strengthens the perception of home-ownership as a sound investment.

True Cost of Home-ownership by Honestmath.com

6. Balancing Portfolios with Real Estate

While real estate has strong appeal, it shouldn’t be the only asset in an investor’s portfolio. At Finomenon Investments, we recommend diversifying across multiple asset classes, including stocks, bonds, commodities, and real estate.

The S&P 500 has delivered an average return of 9.8% since 1980, but real estate provides a valuable counterbalance. Its illiquid nature and lower perceived volatility make it an excellent choice for investors seeking stability in a diversified portfolio. Additionally, with housing prices continuing to rise in many markets, real estate remains a compelling option for long-term gains.

Real estate’s status as America’s favorite investment is unlikely to change anytime soon. Its emotional appeal, historical resilience, and relative lack of visible volatility make it attractive to a broad range of investors. However, we believe in the power of diversification and by spreading your investments across real estate, stocks, bonds, and other asset classes, you can reduce portfolio risk and build a stronger foundation for long-term financial success.

Book a complimentary call to understand your net worth composition and if you are diversified enough across various asset class.

Sources:

Disclaimer: This content is for informational purposes only and should not be considered investment advice. All investments carry risks, including the loss of principal. Finomenon Investments LLC cannot guarantee future results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.