Reducing Your Lifetime Effective Tax Rate: 10 Strategies for W-2 Employees

Maximizing your wealth as a W-2 employee involves strategically reducing your effective tax rate over time. Here are ten actionable strategies to help you lower your taxes legally:

Maximize Retirement Contributions with a Traditional 401(k)

- Contribute to employer-sponsored plans like 401(k) or 403(b). These contributions reduce your taxable income, with 2024 limits set at $23,000 ($30,000 if age 50 or older).

- If your employer does not offer a 401(k), consider contributing to a traditional IRA. For single filers without an employer-sponsored plan, there’s no income limit for contributions, with a maximum deduction of $7,000 (2024).

Utilize Health Savings Accounts (HSAs)

- If you have a high-deductible health plan (HDHP), contribute to an HSA. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- HSAs offer a triple tax advantage: deduction for contributions, tax-free earnings, and tax-free withdrawals. To qualify, your HDHP must have a deductible of at least $1,600 for an individual or $3,200 for a family. The maximum contribution is $4,150 (individual). Contact Shabrish for a complimentary Workplace Compensation and Benefits review.

Leverage Flexible Spending Accounts (FSAs)

- Contribute to FSAs for healthcare or dependent care expenses. These contributions are made with pre-tax dollars, which reduces your taxable income.

Deduct Student Loan Interest

- You can deduct up to $2,500 in student loan interest, which lowers your taxable income even if you don’t itemize deductions.

Utilize Education Plans

- 529 Plan: This plan offers tax-free growth and withdrawals for qualified educational expenses. Contributions aren’t federally deductible but may be deductible at the state level. You can also roll unused 529 assets into a beneficiary’s Roth IRA. At Finomenon Investments, we generally prefer investments with potentially higher returns, especially when education goals are more than a decade away. This decision depends on individual circumstances.

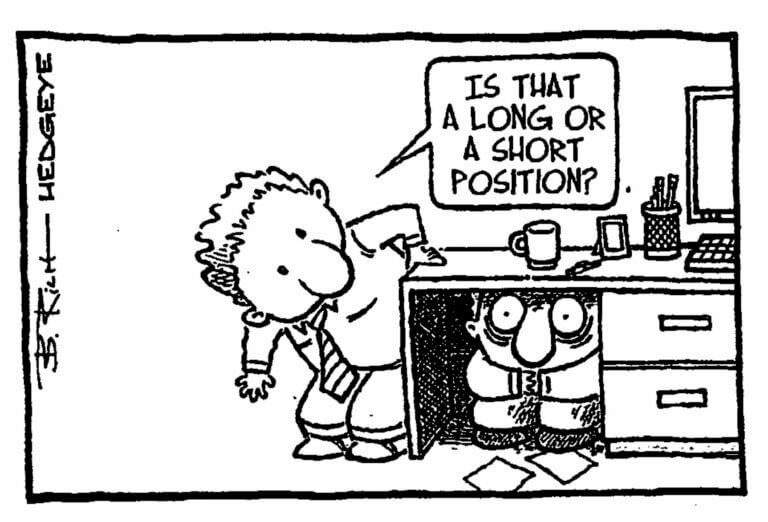

Consider Tax Implications When Harvesting Investments

- Offset capital gains by selling investments at a loss. For example, exit positions you no longer favor, and deduct up to $3,000 of losses against other income.

- Re-balancing your portfolio to manage concentration risk and other factors also has tax implications. Finomenon Investments has helped many executives diversify risk and enhance returns from concentrated stock positions. If this applies to you, reach out for tailored advice.

Contribute to a Dependent Care FSA

- Use pre-tax dollars to cover qualifying child or dependent care expenses if your employer provides this benefit.

Maximize Employer Benefits

- Take full advantage of tax-free employer benefits, such as additional life insurance coverage, educational assistance, and deductible benefits to reduce your taxable income.

Itemize Deductions When Beneficial

- If your itemized deductions exceed the standard deduction, itemizing can further reduce your taxable income. Finomenon Investments collaborates with F2ON CPA to review client accounts annually and make informed decisions based on your financial situation.

Contribute to a Roth IRA

- While Roth IRA contributions aren’t tax-deductible, withdrawals and growth are tax-free. This can protect you against future tax rate increases and does not affect provisional income or Medicare premiums. If you’re ineligible for Roth IRA contributions, consider backdoor strategies.

Implement a Mega Backdoor Roth

- The Mega Backdoor Roth allows you to contribute significantly more to Roth accounts beyond standard limits. Check if your employer’s 401(k) plan permits this strategy and be aware of the disclosure requirements for taxable versus nontaxable contributions.

By implementing these strategies, you can effectively lower your lifetime tax rate and keep more of your hard-earned money. For personalized tax advice tailored to your situation, consult a tax professional on F2ON or book a call with Shabrish.

Disclaimer: This information is not investment advice. All investments carry risks, including potential loss of principal and value fluctuations. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.