In the ever-evolving world of investing, one concept that continues to challenge and shape portfolios is asset allocation. While the term “asset allocation” might seem like a modern buzzword, its significance stretches far beyond the surface. It encapsulates the delicate balancing act between risk and reward that investors must navigate to build portfolios that align with their unique goals, financial situations, and risk tolerances.

The Basics of Asset Classes: Ownership and Debt

At its core, asset allocation boils down to choosing between two fundamental asset classes: ownership and debt. Ownership refers to assets like equities, real estate, and private equity—investments where you have a stake in the underlying business or asset. On the other hand, debt includes bonds, loans, and other fixed-income investments, where you lend money with the expectation of a predetermined return.

The distinction between these two classes is crucial. Ownership assets come with potential upside but significant risk—there’s no guarantee of a return. Debt investments, by contrast, offer fixed returns, typically lower than equities but with far less risk and volatility.

The Offense and Defense Balance

Investors face a fundamental decision: how much of their portfolio should focus on offense (growth) and how much on defense (capital preservation). These two strategies are often mutually exclusive, with growth-oriented portfolios embracing risk in pursuit of higher returns, while defensive portfolios prioritize stability and capital preservation.

The balance between offense and defense is key to building a portfolio that suits an investor’s financial goals. As Howard Marks succinctly put it, “You can’t simultaneously emphasize both preservation of capital and maximization of growth.” Every portfolio must strike its own balance on this continuum of risk and return, and that balance should be consciously targeted rather than left to chance.

Asset Allocation as a Targeted Process

The process of asset allocation is far from a passive exercise. It requires careful consideration of how much risk is appropriate, how much growth is desirable, and what level of volatility an investor is comfortable with. The goal should be optimization, not maximization. In other words, it’s not about simply pursuing the highest possible return—it’s about pursuing returns in a way that aligns with the investor’s needs, goals, and risk tolerance.

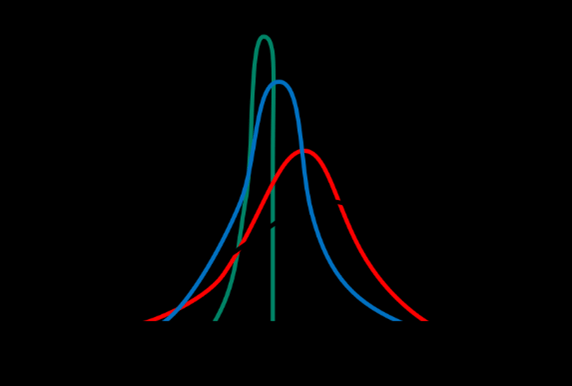

As Howard Marks explains, the risk/return relationship is often misunderstood. While it’s true that taking on more risk can lead to higher returns, it’s important to recognize that the range of possible outcomes also widens. Increased risk can lead to both higher highs and lower lows, and investors need to be prepared for the potential downside that comes with pursuing higher returns.

Navigating Market Cycles and Adjusting Risk

One of the more nuanced aspects of asset allocation is the ability to adjust the offense/defense balance depending on market conditions. When markets are undervalued and pessimism reigns, it might make sense to increase the offensive posture, taking on more risk in search of higher returns. Conversely, when markets are frothy and optimism abounds, a more defensive stance may be appropriate to protect capital from potential downturns.

This dynamic approach requires not only a deep understanding of the markets but also the intestinal fortitude to make difficult decisions in the face of uncertainty. Timing the market perfectly is impossible, but adjusting risk exposure based on market conditions can help investors navigate the inevitable ups and downs.

The Role of Credit in Today’s Environment

As interest rates have shifted upward in recent years, the role of credit investments in portfolios has come into sharper focus. While historically low-interest rates made credit investments unattractive compared to equities, today’s higher yields present a compelling opportunity for investors looking to balance growth and capital preservation.

Credit investments, particularly in the non-investment-grade space, now offer yields competitive with historical equity returns. For investors seeking reliable income streams with less volatility than equities, increasing the allocation to credit can provide both attractive returns and a level of defense against market turbulence.

Tailoring Asset Allocation to the Individual

The key takeaway for any investor is that asset allocation is highly personal. There’s no one-size-fits-all solution, and the right balance between offense and defense will vary depending on factors such as an investor’s financial situation, risk tolerance, time horizon, and investment goals. What remains constant is the need for thoughtful, deliberate decision-making when it comes to allocating assets—decisions that take into account both the potential rewards and the risks inherent in every investment.

Ultimately, the right asset allocation strategy is one that reflects not only an investor’s financial aspirations but also their ability to weather the inevitable ups and downs of the market. By embracing a balanced approach, investors can optimize for long-term success, pursuing growth without sacrificing their financial security.

Disclaimer: Nothing here should be considered as investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.