Rob Arnott’s Research Affiliates Deletions ETF (NIXT): A Case Against Passive Index Investing

At Finomenon Investments, we’ve often discussed the limitations of passive index investing. The launch of Rob Arnott’s Research Affiliates Deletions ETF (NIXT) reinforces this perspective. As we highlighted in a previous blog, following market-weighted indexes blindly carries risks, particularly when such indexes give disproportionate influence to overvalued “frothy” companies.

You may be wondering that If financial markets are generally efficient, this shouldn’t occur. Market capitalization-based weighting is supposed to offer the most accurate projection of future returns. So, what’s really happening?

Arnott’s new ETF focuses on companies that have been removed from major indexes, often undervalued after underperformance. These companies present unique opportunities for recovery, echoing our belief that market-cap-weighted indexing can overlook undervalued stocks.

Unlike passive index funds, which tend to expose investors to companies which are included in the index based on market cap weight-age , Arnott’s smart-beta framework adjusts traditional indexes to reduce the impact of these giants. We’ve pointed out before about pitfalls of index investing, where investors are unknowingly exposed to hyped stocks with frothy valuations.

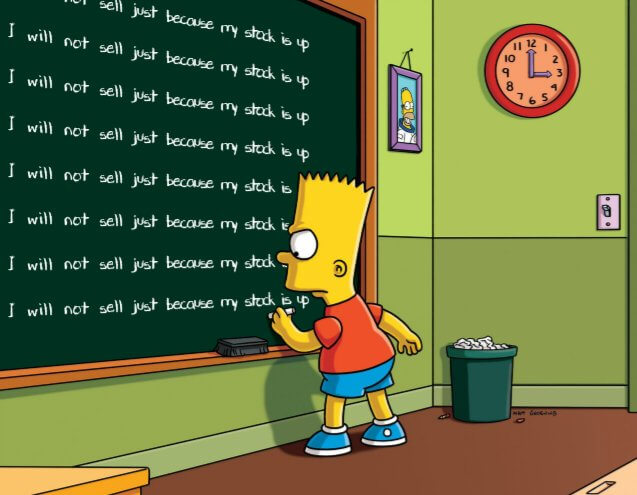

Essentially, this is the paradox of Index investing – “Buy at any Price” —a potentially imprudent approach to investing especially when not diversified enough.

Arnott’s ETF strategy focuses on mean reversion, a phenomenon where underappreciated companies often experience a resurgence. This aligns with Finomenon Investments’ philosophy of looking beyond conventional benchmarks and finding value in neglected opportunities. While index funds offer diversification, Arnott’s method shows that it’s possible to mitigate risks by diversifying outside of the common benchmarks—a concept we previously explored.

By focusing on mean reversion, Arnott reminds investors to avoid chasing performance. It’s essential to stay vigilant and adaptable in portfolio management. Relying solely on passive investing can lead to missed opportunities, and Arnott’s approach offers an alternative path to consider.

For a more in-depth look at the limitations of passive investing, read our full article here.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.

Disclaimer: This article is not investment advice. All investments carry risk, including potential loss of principal. Finomenon Investments LLC cannot guarantee future financial outcomes.