Lessons from the Rockefellers and Vanderbilts

Building wealth is a significant achievement. Ensuring it endures for future generations is an even greater challenge. The stories of the Rockefeller and Vanderbilt families offer valuable insights into the dynamics of generational wealth preservation.

A Tale of Two Legacies

In the late 19th and early 20th centuries, both the Rockefellers and Vanderbilts amassed extraordinary fortunes. Yet, their financial legacies diverged markedly over time.

The Vanderbilt Decline: Cornelius Vanderbilt built a shipping and railroad empire, creating one of the largest fortunes of his era. However, subsequent generations engaged in extravagant spending without a cohesive strategy for wealth preservation. Lavish lifestyles, opulent estates, and a lack of financial discipline led to the rapid depletion of their fortune. By the mid-20th century, the Vanderbilt wealth had largely dissipated.

The Rockefeller Resilience: John D. Rockefeller, founder of Standard Oil, also accumulated vast wealth. Unlike the Vanderbilts, the Rockefellers implemented structured mechanisms for wealth management, including the establishment of trusts, a commitment to philanthropy, and instilling financial stewardship across generations. This strategic approach has allowed the Rockefeller fortune to not only endure but also to support philanthropic endeavors that continue to make a global impact today.

Key Strategies for Generational Wealth Preservation

Drawing from these historical examples, here are five essential strategies to ensure your wealth benefits future generations:

1. Foster Open Financial Dialogue

Encourage transparent discussions about finances within your family. Regular conversations about budgeting, investing, and the family’s financial goals can cultivate a culture of responsibility and shared understanding. Open dialogue helps demystify wealth and prepares heirs for future stewardship.

2. Educate Heirs on Financial Stewardship

Equip your descendants with the knowledge and skills necessary to manage wealth effectively. This includes understanding investment principles, the importance of diversification, and the impact of taxes. Financial literacy empowers heirs to make informed decisions and uphold the family’s financial legacy. At Finomenon, our family office approach considers all members of the household (spouse + dependents) in our financial plan and integrate them into financial decisions and key outcomes.

3. Establish and Uphold Family Values

Define and communicate the core values that guide your family’s approach to wealth. Whether it’s entrepreneurship, philanthropy, or education, aligning financial decisions with these values provides a sense of purpose and direction, fostering unity and continuity across generations.

4. Implement Robust Governance Structures

Create formal structures such as family trusts, foundations, and family office advisor council (s) to manage and oversee the family’s wealth. These can provide clear guidelines for wealth distribution, investment strategies, and philanthropic activities, ensuring that decisions are made in alignment with the family’s long-term objectives.

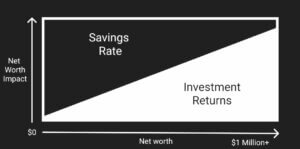

5. Adopt a Long-Term Investment Perspective

Focus on investment strategies that prioritize sustainable, long-term growth over short-term gains. This approach involves prudent risk management, diversification, and a commitment to preserving capital, ensuring that the family’s wealth can support future generations.

Why It Matters for Your Family

The contrasting fortunes of the Rockefeller and Vanderbilt families underscore a timeless truth: wealth needs structure, discipline and consistency.

At Finomenon, we don’t just help families manage money—we help them think in decades, not days. With the right framework, your wealth can do more than grow. It can endure, inspire, and unify.

The contrasting fortunes of the Rockefeller and Vanderbilt families underscore the importance of intentional and strategic wealth management. At Finomenon, we are dedicated to assisting families in developing comprehensive plans that not only preserve wealth but also align with their values and aspirations, ensuring a lasting legacy.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.