In the world of investing, people often chase the highest returns, the next big trend, or the newest financial product. Yet, amidst all this noise, there is one crucial metric that rarely gets enough attention: how well you sleep at night. Sleep Adjusted Return—a concept that measures not just the returns on your portfolio but also how much peace of mind those investments afford you. Risk while measured through volatility in finance is also rooted in behavior and psychology. How one experience it in real, and that can be a function of a whole lot of things rather than just some number on the stock screen. For instance, the abundance or scarcity factor during one’s upbringing and childhood shapes our perspective in risk taking to a great extend.

At its core, sleep adjusted return focuses on a simple truth: the ultimate goal of investing isn’t just maximizing wealth but achieving a balance that supports your well-being.

If you are loosing sleep over your investments, is it truly worth it? More importantly, has your advisor misunderstood your risk profile?

Like the natural rhythms of life, this balance is fundamental to long-term success. Here’s how aligning your investment approach with simplicity, clarity, and personal risk profile leads to more restful nights and a stronger financial future.

1. Clarity in Financial Goals Leads to Peace of Mind

Before looking at numbers, ask yourself why you’re investing in the first place. Are you saving for retirement, building a college fund, or aiming for financial independence by a certain age? Clear financial goals are the cornerstone of a sleep adjusted return. Much like a compass, these financial goals greatly help shape confidence and direction, knowing what you’re aiming for and keeping the big picture in mind can reduce stress and anxiety.

When you know your financial path, you can set realistic expectations and resist the urge to react to market noise. This sense of clarity not only drives better decisions but also leads to a calm confidence that lets you sleep soundly, no matter what the markets are doing.

2. Stick to Proven, Low-Stress Strategies

The financial world has engineered loads of products, but the key to boosting your sleep adjusted return is embracing simplicity. Proven strategies like index fund investing if you are risk averse and dollar-cost averaging (DCA) do just that. Instead of trying to time the market or trading on speculation, a simple index funds will capture the overall market’s growth.

Dollar-cost averaging ensures you regularly invest without stressing over market timing. We do have our own grudges with index investing but still believe that as a low stress product for the know-nothing investor.

Knowing that your investment strategy is both time-tested and sustainable means fewer worries about short-term volatility. In the long run, it’s this steady, stress-free approach that enhances your financial and mental well-being.

3. A Healthy Financial Foundation Eases Your Mind

Financial health is not just about having money invested—it’s about knowing that your personal finances are in order. Before you dive into building an impressive portfolio, ensure you have the basics covered:

- Emergency Fund: An emergency fund is your first line of defense against the unexpected. With 3–6 months of expenses saved, you’ll never have to worry about selling investments at the wrong time. The longer the emergency fund can last, the more robust your foundation is. At Finomenon Investments, a base 3 month emergency fund is a must have.

- Debt Management: No matter how well your portfolio performs, high-interest debt is a drain on wealth—and your peace of mind. Paying off debts with a solid plan takes away a major source of financial stress. We often see Clients who carry credit card balances each month instead of paying in full and have large cash sitting in savings account. The math just doesn’t work.

By taking care of these essential elements, you ensure that your investing doesn’t disrupt your sleep but instead complements a sound, well-rounded and long term financial plan.

4. Understand What You Invest In

Investing in what you know isn’t just about reducing risk—it’s about lowering anxiety. Trying to diversify into unfamiliar, complicated financial instruments can lead to unnecessary worry. By keeping your investments in areas you understand, you reduce the uncertainty that can disturb your peace of mind.

The more you understand, the less you fear the unknown. Knowing your portfolio inside and out is crucial for maintaining the confidence that leads to better sleep.

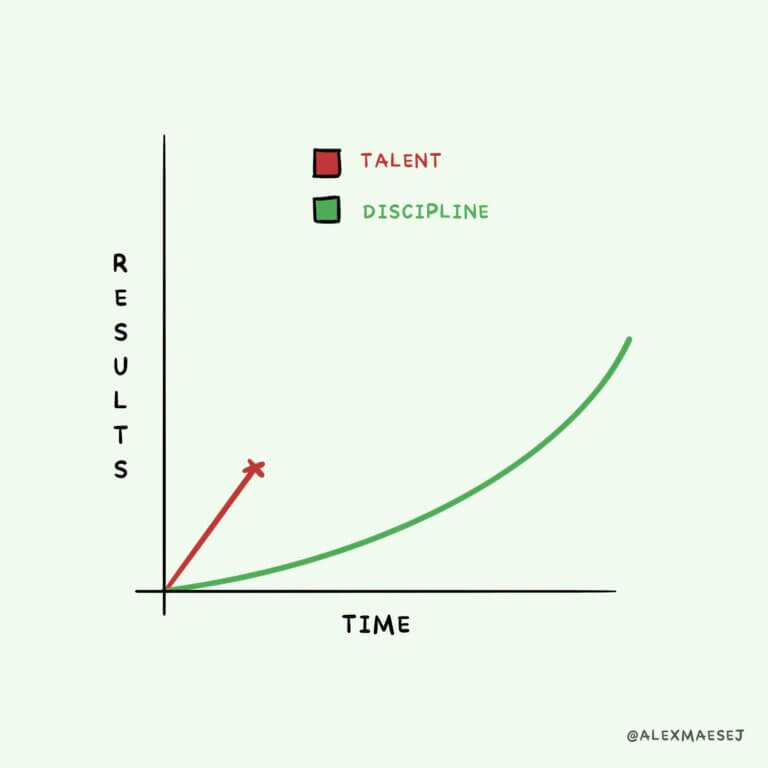

5. Balance Risk and Reward Naturally

Every investor has a unique risk tolerance, and the key to achieving a high sleep adjusted return is finding the right balance for you. Whether it’s a blend of stocks and bonds or diversifying across different industries and geographies, balancing risk and reward according to your comfort zone keeps your stress in check.

Think of it like nature’s balance: growth and protection are essential for long-term sustainability. When your portfolio is aligned with your personal risk appetite, you can endure market fluctuations with less fear and worry.

Ultimately, simplicity leads to clarity, which leads to peace. The less you have to worry about managing your investments, the more mental energy you can devote to enjoying the returns—and your life.

Sleep, Simplicity, and Sustainability

The Sleep Adjusted Return reminds us that the best investment strategy is one that not only grows your wealth but also protects your well-being. At Finomenon Investments, we believe that simplicity, clarity, and a strong financial foundation are the keys to achieving both financial success and personal peace.

We achieve this through our interview process where we understand your personal risk profile and goals.

As we build Client portfolios, we emphasize the importance of a life free of financial anxiety and prefer a simple, well-planned approach that can deliver the most important return: a good night’s sleep.

Book a interview call with Shabrish to learn more about your risk profile.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.