The Social Security system, a cornerstone of America’s safety net, faces an imminent crisis. For decades, the system has operated on a straightforward premise: workers contribute around 6% of their paychecks to Social Security tax, which is then distributed to retirees.

This model worked effectively when the workforce was large and the number of retirees relatively small. However, the shifting demographic landscape increasingly puts the sustainability of this system in question.

The Current Situation

Until 2021, the Social Security Trust Fund maintained a substantial reserve of $2.9 trillion. This surplus allowed the system to pay benefits even when current tax revenues fell short. However, we now draw from this reserve to meet obligations. As a result, 20% of Social Security checks are funded by this shrinking surplus. The retirement of the baby boomer generation and a shrinking workforce further exacerbate the situation, leading to reduced revenue for the system.

The Impending Shortfall

Projections indicate the Social Security Trust Fund will be exhausted by 2033. When this happens, the system will only pay benefits from ongoing tax revenues, which are expected to cover about 77% of scheduled benefits. Legislative action is necessary to prevent a reduction in benefits or a significant increase in payroll taxes.

A Missed Opportunity

One of the most sobering revelations is the missed opportunity from the 1990s. During Bill Clinton’s presidency, a proposal suggested investing the Social Security reserves in the stock market rather than government treasury bills. If these reserves had been invested in the S&P 500, they would have grown by over 300%. While this approach would have involved more risk, the potential rewards could have significantly alleviated the Social Security deficit.

What Does It Mean for You?

Given the current trajectory, addressing the Social Security shortfall requires careful consideration and action. Here are some potential impacts:

- Increase in Payroll Tax Rate: Raising the Social Security tax rate from 6% could generate additional revenue. However, this approach would need careful balancing to avoid an undue burden on workers and employers.

- Adjust Benefits: Reducing benefits for future retirees could help extend the life of the Trust Fund. This could involve altering the formula for benefit calculations or changing eligibility criteria.

- Raise the Retirement Age: Increasing the age at which individuals can claim full benefits would reduce the length of time benefits are paid. However, this may not be feasible or fair for all demographics, especially those in physically demanding jobs.

Social Security System Faces a Critical Juncture

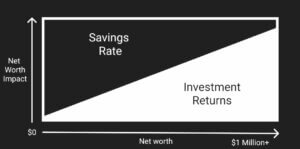

Solving this dilemma requires a balanced approach that considers the economic impact on workers, retirees, and the overall fiscal health of the country. As we approach 2033, lawmakers must act decisively to preserve this vital program for future generations. In the meantime, relying solely on Social Security benefits isn’t ideal for retirement planning. A diversified portfolio that anticipates cash flow needs for lifestyle and essential expenses, while staying immune to market volatility, is key to producing that income.

Have you reviewed your investment performance relative to the market and your expectations?

Get a free portfolio review today!

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including the possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.