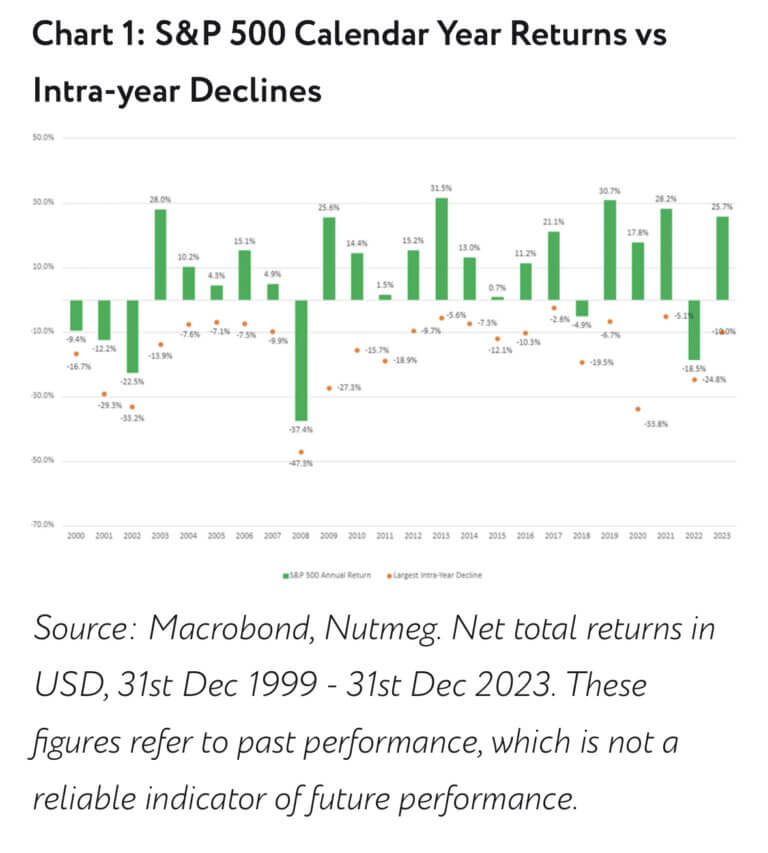

The S&P 500’s historical performance, as shown in the chart, serves as a powerful reminder that market downturns are often followed by recoveries. While it’s difficult to predict the timing and severity of market corrections, history suggests that those who maintain a long-term perspective and resist the urge to make hasty decisions are more likely to achieve their financial goals.

The recent fluctuations in the S&P 500, as illustrated in the chart above, provide a stark reminder of the inherent unpredictability of investing in stocks. The chart, which compares the S&P 500’s calendar year returns with the largest intra-year declines, highlights a key truth for investors: significant drops in the market are not uncommon, yet more often than not, the market ends the year in positive territory.

Understanding Market Volatility

The S&P 500’s performance over the last two decades underscores the fact that market volatility is part and parcel of equity investing. For example, in 2020, despite an intra-year decline of 33.8%, the S&P 500 managed to end the year with a gain of 18.5%. Similarly, in 2009, the market plunged by 27.3% during the year but recovered to deliver an annual return of 23.5%. These instances, along with numerous others depicted in the chart, illustrate that short-term declines do not necessarily dictate long-term outcomes.

Reacting to Market Volatility

When faced with sharp market declines, it’s natural to feel anxious. However, the worst reaction to market volatility is often an impulsive one. Panic selling during a market downturn can lock in losses and potentially cause investors to miss out on subsequent recoveries. The chart shows that, historically, the S&P 500 has consistently bounced back from significant intra-year declines to finish the year in positive territory more often than not.

Instead of reacting to short-term market movements, it is crucial to focus on long-term investment goals. Historically, those who stay invested through turbulent times are often better positioned to benefit from eventual market rebounds. At Finomenon Investments, our cash flow analysis makes every dollar count and makes capital allocation perceptive. This means even with volatility, we know the anticipated cash flow needs into the future and cut being cornered into taking short term actions.

Is It Just About Avoiding Rash Decisions?

The temptation to “do something” during market turbulence is powerful. However, making decisions based on short-term market movements can be detrimental to your financial health. A well-thought-out investment strategy, aligned with your financial goals and risk tolerance, should be resilient enough to weather market volatility.

Our approach to mitigating the impact of market fluctuations is diversification and Planning. By spreading investments across various asset classes, you can reduce the overall risk in your portfolio. Moreover, maintaining a disciplined approach to investing—rebalancing your portfolio as needed and staying true to your strategy—can help you avoid making decisions driven by emotion.

Source Credit: HighView Finance

In times of market volatility, it is essential to remain focused on your long-term objectives, keep a well-diversified portfolio, and avoid the temptation to react to short-term market swings. By doing so, you can navigate the ups and downs of the market with confidence, knowing that, over time, the markets have shown a strong tendency to recover and grow.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.