At Finomenon Investments, we emphasize the importance of long-term Investing when investing in equities. This approach emphasizes the power of compounding, ensuring that time in the market works to our clients’ advantage.

In-fact, we have been particularly clear about our orientation towards equity as an asset class through our Investment Policy Statement. This is due to the fact that equities has the best long term track record of delivering healthy returns to investors.

Terry Smith, the famous London based fund manager known as the Buffett of Britain and CEO of fundsmith, reinforced this view, in an old FT article in 2017, showcasing how equity investments stand out among other asset classes, such as bonds and real estate. Equities offer unmatched potential for compounding by reinvesting earnings—leading to exponential growth over time.

The Advantage of Equity: Reinvested Growth

Companies that can reinvest profits into their own operations—rather than paying out large dividends—should be particularly attractive to equity investors. These reinvested earnings allow companies to grow, increasing their value and the value of investment. The beauty of this compounding effect is that, unlike bonds or real estate, equity investments allow profits to be reinvested directly into the business, potentially yielding exponential growth over time.

Compounding Illustrated

Equities have the unique ability to compound in value in ways that bonds, real estate, and other asset classes cannot. Companies can choose to distribute between 0% and 100% of their profits to investors through dividends or share buybacks, while reinvesting the remainder back into the business.

S&P 500 companies typically retain around half of their earnings for reinvestment, while distributing the other half to shareholders. This reinvestment of earnings is a distinct advantage of equity investing.

In contrast, bondholders receive interest payments, but none of these payments are automatically reinvested into the same bond or other bonds. Similarly, landlords earn rental income, but that income is not automatically reinvested into the property. This lack of automatic reinvestment in bonds and real estate sets them apart from equities, where reinvesting profits back into the business fuels growth and compounding.

Returns from companies in the S&P 500 can be broken down into two components: growth and yield.

- Return on Equity (ROE) for S&P 500 companies is higher (13%) compared to the broader universe of nonfinancial companies (11%), reflecting the fact that larger, more profitable companies are included in the index. Higher ROE often correlates with better long-term profitability and growth prospects.

- If companies reinvest half of their profits at a 13% return, this reinvestment drives future growth. In this case, profits would grow at a rate of 6.5% (half of 13%).

- The dividend plus buyback yield of 3.5% represents the portion of profits that companies return to shareholders in the form of dividends or share repurchases, which directly adds to investor returns.

When combined, the expected total shareholder return could be roughly 10% per year (6.5% profit growth + 3.5% yield). However, actual investor returns can vary due to market conditions, changes in valuation multiples, and economic factors. This breakdown offers insight into how corporate profitability and capital allocation impact long-term stock returns.

Why Equity Compounding Works So Well

The true power of equity compounding shines when retained earnings create additional value. For every $1 of retained earnings, companies in the S&P 500 with high Return on Invested Capital (ROIC) or ROE, generate greater market value by simply reinvesting that capital.

This demonstrates that when earnings are reinvested into well-run businesses with strong growth potential, returns can compound significantly.

Other asset classes, like bonds and real estate, don’t offer the same compounding benefits. Bonds provide fixed interest, and while real estate can offer rental income, it doesn’t typically generate the same scale of exponential growth as reinvested equity profits.

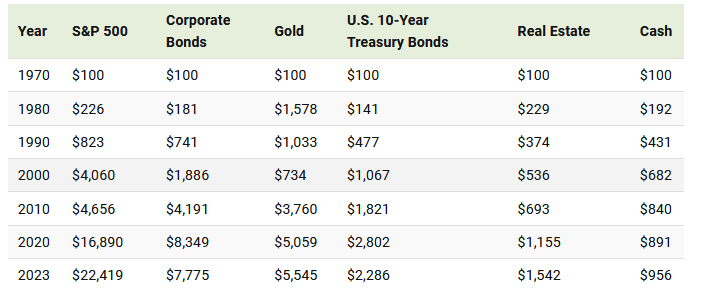

Below, we show the returns of a $100 investment across major asset classes—from U.S. stocks to gold—between 1970 and 2023

Source: Visual Capitalist

Not All Companies Are Created Equal

However, not every company offers the same compounding potential. We wisely caution, that finding businesses capable of consistently reinvesting earnings at a high rate of return is crucial. Randomly picking stocks or focusing only on high dividends won’t lead to success.

Companies that generate high returns often attract competition, leading to mean reversion—a theory suggesting profits will eventually return to average levels over time.

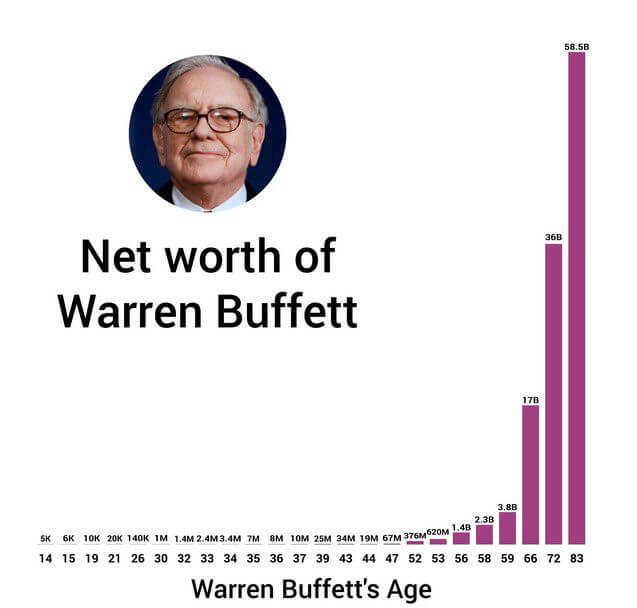

As Warren Buffett has often said, investors should seek out businesses with a sustainable competitive advantage, or an “economic moat.” These companies are more likely to continue delivering outsized returns on reinvested earnings over the long term.

A Strategy for Long-Term Investors

At Finomenon Investments, we aim to maximize long-term wealth creation for our clients. Terry Smith’s insights affirm our belief in the power of equity compounding. While the path to wealth involves risk, particularly in the short term, equities offer better long-term growth potential—especially when choosing companies that can reinvest profits at a high rate of return.

Having a diversified portfolio of investments across equity and fixed income instruments can improve the return /risk profile. A Financial Plan can help make the right choices, and make capital allocation more perceptive.

If you’d like to explore how compounding can fit into your investment strategy, we at Finomenon Investments are here to guide you. Book a complimentary call to review your portfolio and get feedback.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.

Disclaimer: This content is for informational purposes only and should not be considered investment advice. All investments carry risks, including the loss of principal. Finomenon Investments LLC cannot guarantee future results.