“All progress depends on the unreasonable man.” — George Bernard Shaw

At first glance, this quote sounds like a provocation. In a world that prizes rationality, data, and logic, why should we listen to someone who champions unreasonableness?

Because, in many cases, that’s where real progress begins.

Why Being an Unreasonable Investor Matters

The term unreasonable investor may sound counterintuitive. After all, isn’t successful investing about discipline, structure, and rationality?

Yes—but not only that.

To generate truly extraordinary outcomes, you must occasionally hold views that seem irrational to others. Breakthroughs don’t start in consensus. They begin with ideas that feel uncomfortable, risky, or even foolish.

Let’s look at two powerful examples.

Newton and the Paradox of Belief

Isaac Newton was a pioneer in calculus and physics. Yet he also devoted years to studying alchemy, trying to turn base metals into gold. It seems bizarre today, but at the time, both pursuits emerged from his insatiable desire to understand how the world works.

What we now view as absurd once coexisted with genius.

– Shabrish Menon

The Wright Brothers and Ridicule

In 1903, two bicycle mechanics from Ohio launched the first manned, powered flight. It lasted just 12 seconds. Experts scoffed. The New York Times predicted it would take another million years before humans could fly.

But the unreasonable belief of the Wright brothers created modern aviation.

Vision or Delusion? The Line Is Razor Thin

When it comes to investing, the unreasonable investor often walks a fine line between genius and delusion.

We call this variant perception—seeing something different from the crowd and being right. That distinction is critical. Just seeing differently isn’t enough. You must also have:

- A process to validate your thinking

- The discipline to manage downside risk

- The conviction to stay the course

Vision becomes delusion only in hindsight. And success depends on how you surround that vision with execution.

Five Mental Models of the Unreasonable Investor

Let’s break this down into five principles you can apply in your own investment process.

1. Vision Often Looks Irrational—Until It Works

Every great idea starts by looking crazy. The unreasonable investor is willing to appear foolish today to be proven right tomorrow.

In markets, early conviction frequently invites criticism. But being early is not the same as being wrong.

2. Asymmetric Outcomes Require Non-Consensus Thinking

The biggest wins come from bets that look uncomfortable. To achieve asymmetric outcomes—where upside potential far exceeds the downside—you must take a position outside the mainstream.

This is why groupthink is the enemy of breakthrough investing.

3. The Line Between Genius and Delusion Is Only Clear in Retrospect

Conviction and obsession drive both legendary success and spectacular failure. But the trait isn’t what defines the outcome. Execution does.

Risk-taking isn’t reckless when paired with thoughtful sizing and discipline.

4. It’s Not About Being Right. It’s About Seeing Differently—and Managing Risk

The unreasonable investor isn’t trying to be right all the time. They’re trying to create a portfolio of ideas that work over time.

What separates them from gamblers is their risk framework. They’re structurally prepared to be wrong—but ready to capitalize when they’re right.

5. Consensus Is Comfortable—but Rarely Profitable

In investing, safety often comes at the cost of returns. The comfort of consensus typically signals a fully priced idea.

To generate alpha, you must ask:

What am I seeing that others aren’t?

Where is my thinking different—and why might it be right?

Investing Is About Conviction With Calibration

The unreasonable investor doesn’t chase wild ideas. Instead, they build a system around:

- Differentiated insights

- Consistent position sizing

- Asymmetric payoffs

- Downside protection

- Long-term patience

This combination allows them to stay invested long enough to benefit from their insight—without blowing up when they’re wrong.

They aren’t reckless. They’re calibrated.

Final Thoughts: Choose Your Uncertainty

In the end, investing is about choosing the type of uncertainty you’re willing to accept.

Rational investing isn’t about avoiding risk. It’s about leaning into the right risks with discipline, resilience, and clear thinking. It’s about building a process that gives you the staying power to win—not because you’re always right, but because you stay in the game long enough for your edge to show.

So if your ideas feel “unreasonable” today, ask yourself this:

Are they wrong? Or are they just early?

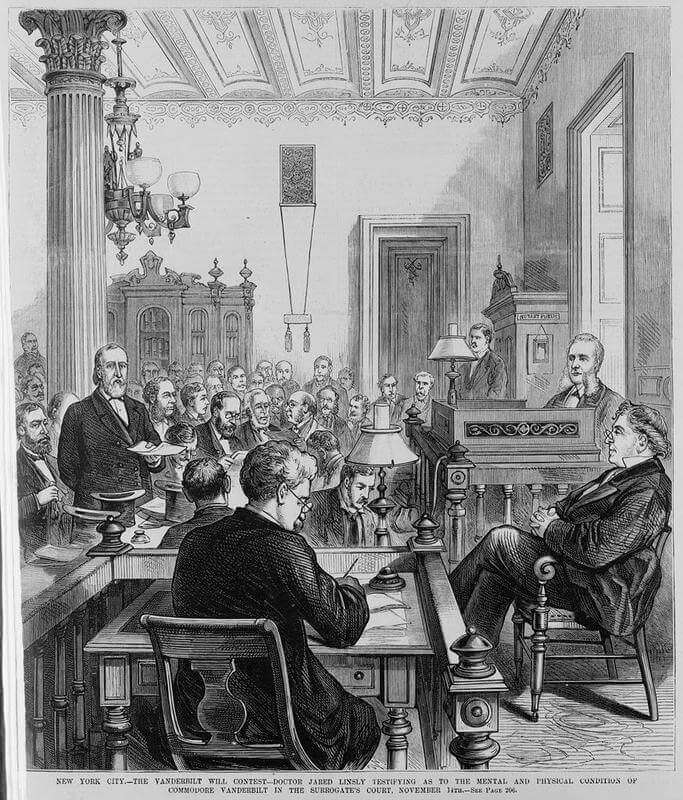

Image Credit: Public Library and Resource

Disclaimer: Nothing here should be considered investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.