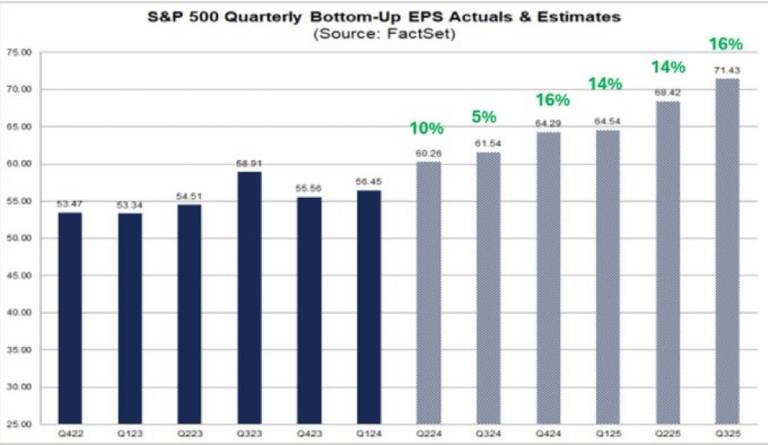

As the U.S. stock market continues to reach new heights, many investors and analysts are optimistic, buoyed by what appears to be a strong earnings environment. The chart from FactSet highlights this sentiment, showcasing both actual and projected earnings per share (EPS) for the S&P 500. If these estimates materialize, we could witness earnings growth hitting 16% year-over-year by the end of 2025. While this outlook might seem to signal a bright future for U.S. companies, the underlying reality suggests that the real challenge isn’t earnings—it’s the inflated expectations driving the market.

But first, lets dig deeper into the earnings part

The data in the chart indicates a steady increase in EPS, with significant growth expected from Q324 onwards. Analysts are predicting a 16% growth rate by Q325, an ambitious target given the broader economic context. The U.S. economy is projected to grow at 3% in the second half of 2024, fueled by resilient consumer spending, strong labor markets, and the early benefits of the AI revolution. However, the market’s expectations seem to assume not just economic stability but an outright boom.

The Expectations Problem

This brings us to the core issue: U.S. stocks don’t have an earnings problem—they have an expectations problem. When expectations are set this high, even strong earnings can disappoint if they fall short of these ambitious forecasts.

Investors are banking heavily on the AI boom to push earnings multiples to 21x, significantly above historical averages. While AI certainly holds transformative potential, counting on such speculative growth to justify current valuations is risky. If AI’s impact on productivity and profitability doesn’t live up to expectations or if macroeconomic conditions deteriorate, a significant correction could be in store.

Then there Is The Buffett Indicator: A Warning Sign

Adding to the concern is the Buffett Indicator, a widely respected metric that compares the total value of the stock market to GDP. This ratio fluctuates over time because the stock market’s value can be highly volatile, while GDP tends to grow more predictably. Currently, the Buffett Indicator sits at an alarming 202%, which is approximately 63.27% (or about 2.0 standard deviations) above the historical trend line. This suggests that the stock market is strongly overvalued relative to GDP, adding another layer of risk to the current market environment.

The significant divergence between stock market valuations and GDP growth highlights the extent to which market prices are driven by speculative expectations rather than fundamental economic growth. This overvaluation, as indicated by the Buffett Indicator, implies that the market is priced for perfection, leaving little room for error.

Expectation Is A Denominator

The risk lies in the gap between sky-high expectations and the actual performance of companies and the economy. Markets are quick to punish any deviation from expected outcomes and draw-downs can cause investors to panic and retirement income mismatch. If EPS growth falls short of the projected 16% by the end of 2025, or if economic growth disappoints, we could see a sharp re-rating of stock prices, particularly in a market already deemed to be significantly overvalued.

Given that the market’s current trajectory assumes nearly flawless execution of corporate strategies and a favorable economic backdrop, any disruption—whether from rising interest rates, inflationary pressures, or slower-than-expected AI adoption—could trigger a significant market correction.

How are we Advising Clients OF Finomenon Investments?

While the earnings outlook for U.S. stocks appears strong on the surface, it’s essential to temper these expectations with a dose of realism. The projected EPS growth rates and lofty valuation multiples, combined with a Buffett Indicator flashing strong overvaluation, suggest that the market is vulnerable to disappointment. Investors should be cautious, recognizing that the real challenge for U.S. stocks may not be earnings themselves, but the sky-high expectations surrounding them.

In such an environment, prudence is key. Even the most compelling growth stories can unravel if they fail to meet the market’s inflated expectations and lead to permanent capital loss. This is why at Finomenon Investments, we follow a Household Level Cash Flow strategy, which allows us to maximize the table stakes opportunities, create a solid foundation in terms of liquidity and emergency fund and dollar cost average where possible and advise Clients to never chase the next big thing.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: MarketValuation