Why Investors Still Prefer Delegation

In recent years, there has been a growing push for transparency and increased investor involvement in corporate governance. In response, Vanguard, the $9.7 trillion asset manager, launched an experiment in 2023 aimed at enhancing shareholder democracy. The initiative allowed investors in select funds to vote on key corporate governance issues directly. While this presented a unique opportunity for investors to influence major corporations, the results revealed a surprising trend: nearly half of the participants chose to let Vanguard continue voting on their behalf.

This raises an important question: why, even when given the chance, do many investors prefer delegation over direct involvement?

An Honest Attempt to Empower Shareholders

In early 2023, Vanguard rolled out a pilot program that invited shareholders in five of its funds to cast their votes on company proposals. The initiative offered a range of voting options, including:

- Voting alongside the company’s board

- Abstaining

- Voting with an ESG (environmental, social, and governance) focus

- Or deferring to Vanguard’s recommendations

This move aligned with a broader industry trend toward democratizing shareholder voting, fueled by political and social pressures, particularly around ESG issues. Other major asset managers, such as BlackRock and State Street, have launched similar programs aimed at shifting voting power back to investors.

Delegation Still Dominates

Despite the excitement surrounding Vanguard’s program, the results showed that a large portion of investors remained hesitant to engage in proxy voting directly. Around 45% of shareholders chose the default option, allowing Vanguard to continue voting on their behalf. This preference for delegation suggests that while shareholders value the ability to vote, many trust institutional managers like Vanguard to make the right decisions.

John Galloway, Vanguard’s global head of investment stewardship, noted that the firm’s voting policy prioritizes long-term value creation, which resonates with many investors. In essence, shareholders appear comfortable relying on Vanguard’s expertise.

“Vanguard’s Investment Stewardship team has a clear, consistent, and compelling mandate to safeguard and enable long-term investment returns at the companies in which Vanguard-advised funds invest” – John Galloway, Global Head of Investment Stewardship

The remaining results showed some diversity:

- About 30% of participants voted in line with company boards,

- Nearly a quarter supported ESG-related proposals, reflecting the growing interest in sustainability and corporate responsibility among investors.

However, the fact that almost half of participants preferred delegation highlights the continuing trend of investor reliance on institutional decision-makers.

Why Do Investors Avoid Direct Voting?

This tendency to defer proxy voting responsibilities is not unique to Vanguard. Other asset managers, such as BlackRock and Schwab, have observed similar trends. There are a few key reasons for this:

- Complexity of Proxy Voting: Corporate governance is intricate. For most retail investors, wading through detailed proposals on executive compensation, mergers, and ESG policies can be overwhelming. As one expert observed, “Proxy voting has become a political football,” with issues becoming increasingly complex and polarized.

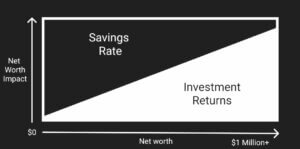

- Time and Effort: Many retail investors choose mutual funds or exchange-traded funds (ETFs) to avoid day-to-day decision-making. Proxy voting often feels like another layer of responsibility that doesn’t align with their long-term investment goals, such as retirement planning.

- Trust in Expertise: Investors often trust asset managers to act in their best interest. Eric Balchunas, an ETF analyst at Bloomberg Intelligence, suggests that many investors remain indifferent to proxy voting, assuming that firms like Vanguard or BlackRock will vote in ways that align with their financial objectives.

Backdrop: ESG and Shareholder Activism

Vanguard’s experiment in shareholder democracy comes amid rising tensions over ESG investing and corporate governance. ESG issues are now at the forefront of corporate policy discussions, and asset managers have faced increasing criticism for wielding significant influence over companies through their proxy votes.

Critics argue that asset managers control too much power, often holding 15% to 20% of shares in major U.S.-listed companies. This has led to political and social pressure from both sides: some claim managers push ESG agendas too aggressively, while others argue they are not doing enough.

In response to these criticisms, Vanguard, BlackRock, and others are transferring more voting power back to shareholders. However, as the results of Vanguard’s pilot program show, many investors are content to let these firms continue making decisions on their behalf.

What’s Next for Shareholder Democracy?

Vanguard’s shareholder democracy experiment is still in its early stages, but the initial results provide valuable insights into investor behavior. Retail investors’ willingness to engage in proxy voting remains low, and the complexity of corporate governance issues is likely a key factor.

As political and social pressures, particularly around ESG, continue to grow, asset managers may expand and refine these voting programs. In the future, we could see more granular voting options or increased efforts to educate shareholders about corporate governance. But for now, it seems that many investors are happy to leave these decisions in the hands of institutional managers.

Key Insight

Vanguard’s experiment in shareholder democracy reveals a notable insight: while many investors appreciate the option to vote their shares, a large portion still prefers to delegate that responsibility to trusted asset managers. As corporate governance and ESG issues become increasingly politicized, asset managers will continue to walk a fine line between responding to these pressures and managing investor apathy. For now, it appears that many investors trust the experts to vote in their best interests.

Finomenon Investments does not vote Client proxies. Clients maintain exclusive responsibility for: (1) voting proxies, and (2) acting on corporate actions pertaining to the Client’s investment assets. If the Client would like our opinion on a particular proxy vote, they may contact us at support@finomenon.us

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.