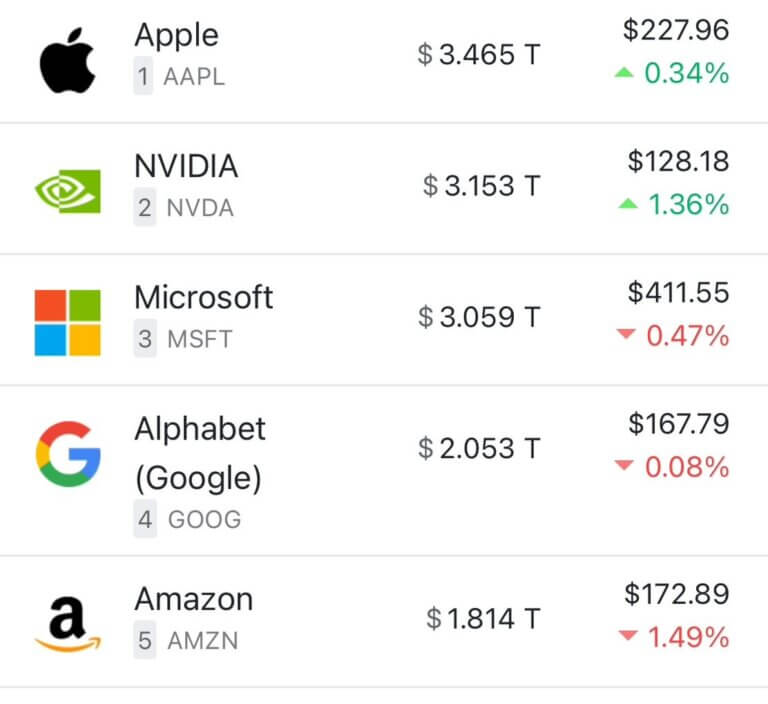

Take a look at the market cap of 10 largest companies: Snapshot Aug 2024.

- Apple (AAPL) – Market Cap: $3.465 trillion, Stock Price: $227.96

- NVIDIA (NVDA) – Market Cap: $3.153 trillion, Stock Price: $128.18

- Microsoft (MSFT) – Market Cap: $3.059 trillion, Stock Price: $411.55

- Alphabet (Google) (GOOG) – Market Cap: $2.053 trillion, Stock Price: $167.79

- Amazon (AMZN) – Market Cap: $1.814 trillion, Stock Price: $172.89

- Saudi Aramco (2222.SR) – Market Cap: $1.796 trillion, Stock Price: $7.43

- Meta Platforms (Facebook) (META) – Market Cap: $1.316 trillion, Stock Price: $520.46

- Berkshire Hathaway (BRK-B) – Market Cap: $993.55 billion, Stock Price: $460.92

- TSMC (TSM) – Market Cap: $878.15 billion, Stock Price: $169.33

- Eli Lilly (LLY) – Market Cap: $857.52 billion, Stock Price: $952.35

These companies represent a mix of technology, energy, and pharmaceutical industries, with Apple leading as the most valuable company in the world. These also represent Index Funds. Lets say the combined market capitalization of these companies is approximately $19.39 trillion.

To determine the percentage of top index that this represents, you would compare this number to the total market cap of the specific index, such as the S&P 500. For example, the S&P 500 Market Cap is at a current level of 45.84T, up from 44.08T last month and up from 37.16T one year ago, these companies would represent about 48.5% of that index.

This is the key insight which drives our point of view shared this in this blog about the pitfalls of index investing.

Disclaimer: Nothing here should be considered an investment advice. All investment carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.