Markets are in constant motion—rising and falling daily, often leaving investors wondering: What causes these fluctuations? Understanding the factors behind these changes can help investors make more informed decisions and develop better long-term strategies. In this blog, we’ll break down why markets fluctuate and how you can navigate these shifts with confidence.

1. Supply and Demand Dynamics

At the core of market fluctuations is the principle of supply and demand. When there are more buyers than sellers for a particular asset, prices tend to rise. Conversely, when sellers outnumber buyers, prices fall. For instance, if a company releases strong earnings or new, innovative products, demand for its stock may increase, pushing prices up. On the flip side, poor earnings or economic setbacks can decrease demand, causing prices to drop.

2. Economic Indicators

Economic conditions play a significant role in market fluctuations. Factors such as inflation, interest rates, employment figures, and GDP growth influence investor sentiment. For example, high inflation or rising interest rates might make it more expensive for companies to borrow money, which could dampen their growth prospects. Investors might respond by selling off stocks, leading to a market downturn. Positive economic reports, such as low unemployment or strong GDP growth, often inspire confidence, leading to market rallies.

3. Investor Psychology and Market Sentiment

Human psychology has a powerful influence on market fluctuations. As Benjamin Graham famously noted with his “Mr. Market” metaphor, investor emotions can drive markets in unpredictable ways. When investors feel optimistic about the future, they may drive up stock prices in a surge of enthusiasm, known as “irrational exuberance.” Conversely, fear and pessimism during times of uncertainty or crises can lead to market sell-offs, even if the underlying fundamentals haven’t significantly changed.

This emotional aspect often leads to volatility, where short-term news or trends can cause sharp price movements even when long-term fundamentals remain intact. That’s why it’s critical for investors to remain disciplined and avoid getting swept up in the emotional tide.

4. Global Events and Geopolitics

Unforeseen global events—such as political instability, wars, pandemics, and natural disasters—can cause significant market fluctuations. These events introduce uncertainty, and markets generally don’t respond well to uncertainty. Take the COVID-19 pandemic as an example: it caused a rapid and dramatic market decline in early 2020, as businesses shut down and economies grappled with lockdowns. Conversely, once vaccine progress and economic recovery efforts began, markets rallied again.

Political elections, changes in government policies, trade wars, and even tensions between countries can similarly lead to volatility, as investors try to predict how these factors will impact businesses and economies.

5. Corporate Performance and Earnings Reports

Publicly traded companies release earnings reports on a quarterly basis, providing updates on their financial performance. These reports can significantly affect short term (and sometimes long term as well) stock prices. If a company exceeds earnings expectations, its stock may rise. If it falls short or provides a gloomy outlook for the future, the stock may drop. Corporate news, such as mergers, acquisitions, or leadership changes, can also affect how investors perceive the future value of a company. Recently, Starbucks announced a change in leadership, driving up their stock price by almost 10% intra day.

6. Technological Innovation and Industry Disruption

Innovation has the power to create both booms and busts in the market. A breakthrough technology can lead to an entire industry booming, as seen with the rise of tech giants in the 1990s and early 2000s. Similarly, industries facing disruption from new technologies—think of how streaming services have impacted traditional media companies—may see stock prices tumble. Market fluctuations occur as investors try to determine which companies will thrive and which may be left behind.

7. Market Speculation and Herd Behavior

Speculation plays a huge role in market volatility. Investors often make decisions based on speculation about what might happen, rather than what’s already occurring. This speculative behavior can drive prices up or down rapidly. Herd behavior, where investors follow the crowd rather than analyzing the facts for themselves, can amplify these movements. We saw this with the rise and fall of meme stocks like GameStop, where online forums and collective buying led to enormous price swings in a short period.

A Framework to Navigate Market Fluctuations

While market fluctuations are inevitable, they don’t have to derail your investment strategy. Here are a few key takeaways to keep in mind:

- Focus on the Long Term: Markets may fluctuate daily, but over time, they have historically trended upward. Keeping a long-term perspective can help you ride out short-term volatility. At Finomenon Investments, this is built into our tenets which guide us when we build relationships and client portfolios.

- Diversify Your Investments: Diversifying your portfolio across different asset classes, industries, and geographies can reduce the risk of being overly exposed to market downturns in any one area.

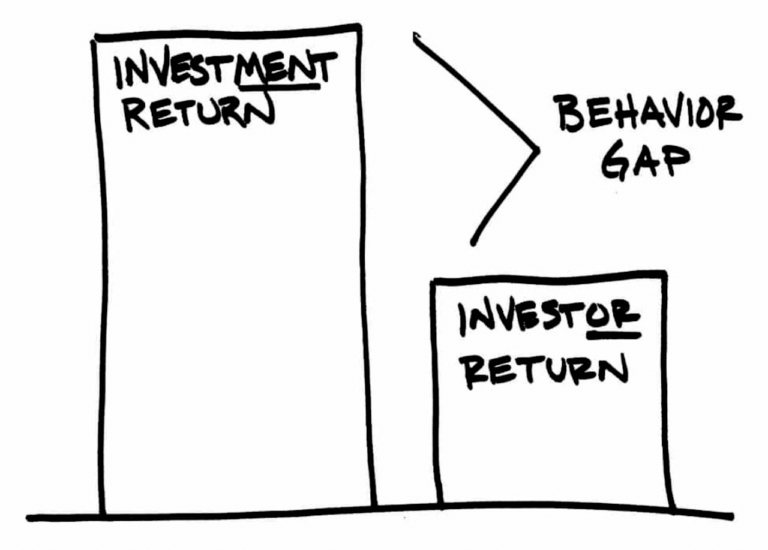

- Avoid Emotional Reactions: Emotional investing—whether it’s chasing hot stocks during a bull market or panic selling during a downturn—can hurt long-term returns. Staying disciplined and sticking to your investment strategy is crucial.

- Regularly Rebalance Your Portfolio: As markets fluctuate, your portfolio’s asset allocation may shift. Rebalancing periodically ensures that you maintain the appropriate risk level for your goals.

- Seek Professional Guidance: If navigating market fluctuations feels overwhelming, consider working with a fee only advisor who can help you create a solid investment plan tailored to your needs.

Market fluctuations are driven by a range of factors, from economic conditions and corporate performance to investor psychology and global events. While they can seem daunting, understanding what causes these fluctuations can help you better navigate them and make informed decisions. By maintaining a long-term view, staying disciplined, and avoiding emotional reactions, you can stay on track toward your financial goals—even in the face of market volatility.

Ready to learn how Finomenon Investments can help you navigate market fluctuations with confidence? Book a free consultation today!

Disclaimer: Nothing here should be considered as investment advice. All investments carry risks, including possible loss of principal and fluctuation in value. Finomenon Investments LLC cannot guarantee future financial results.

Image Credit: Images used are not created by Finomenon Investments, please share the source and author of the illustrator if you know to help give them credit.